Long-Term Performance of Energy

Efficiency Loan Portfolios

March 2022

DOE/EE-2561

March 2022 www.seeaction.energy.gov ii

Lo

ng-Term Performance of Energy Efficiency Loan Portfolios was developed as a product of the State and Local

Energy Efficiency Action Network (SEE Action), facilitated by the U.S. Department of Energy and the U.S.

Environmental Protection Agency. Content does not imply an endorsement by the individuals or organizations that

are part of SEE Action working groups, or reflect the views, policies, or otherwise of the federal government.

This document was final as of March 2022.

If this document is referenced, it should be cited as:

State and Local Energy Efficiency Action Network (SEE Action). (2021). Long-Term Performance of Energy Efficiency

Loan Portfolios. Prepared by: Jeff Deason, Greg Leventis, and Sean Murphy of Lawrence Berkeley National

Laboratory.

FOR MORE INFORMATION

Regarding Long-Term Performance of Energy Efficiency Loan Portfolios, please contact:

Jeff Deason Greg Leventis

Berkeley Lab Berkeley Lab

JADeason@lbl.gov [email protected]

Regarding the State and Local Energy Efficiency Action Network, please contact:

Johanna Zetterberg

U.S. Department of Energy

March 2022 www.seeaction.energy.gov iii

Acknowledgments

The work described in this study was funded by the U.S. Department of Energy’s Office of Weatherization and

Intergovernmental Programs and the Office of Strategic Analysis under Lawrence Berkeley National Laboratory

Contract No. DE-AC02-05CH11231.

The authors would like to thank Emily Basham (Connecticut Green Bank), Joe Buonannata (Inclusive Prosperity

Capital), Peter Krajsa (National Energy Improvement Fund), Kerry O’Neill (Inclusive Prosperity Capital), Todd Parker

(Michigan Saves), Jeff Pitkin (NYSERDA), and Mary Templeton (Michigan Saves) for their contributions to this

report. The authors would also like to thank the U.S. Department of Energy’s Johanna Zetterberg, Sean Williamson,

and Ookie Ma for their guidance and input.

This report was reviewed by: Neda Arabshahi (Inclusiv), Dana Clark (Nutmeg State Financial Credit Union), Brian

Ford (KBRA), Anna Maria Garcia (Department of Energy), Lain Gutierrez (CleanFund), Eric Hangen (University of

New Hampshire), Bert Hunter (Connecticut Green Bank), Peter Krajsa (National Energy Improvement Fund), Ookie

Ma (Department of Energy), Eddie McRoberts (OmniCap), Eric Neglia (KBRA), Kerry O’Neill (Inclusive Prosperity

Capital), Jeff Pitkin (NYSERDA), Al Quintero (Ramirez), Valerie Schuette (True CCU), Jeff Smith (OmniCap), Mary

Templeton (Michigan Saves), Cal Vinal (Capital for Change), Keith Welks (Pennsylvania Treasury), and Sean

Williamson (Department of Energy).

The authors would like to give a special thank you to Bryan Garcia (Connecticut Green Bank) and Bruce Schlein

(OMERS Infrastructure Management Inc), and the State and Local Energy Efficiency Action Network’s Financing

Solutions Working Group, who helped conceptualize and guide this project.

Disclaimer

This document was prepared as an account of work sponsored by the United States Government. While this

document is believed to contain correct information, neither the United States Government nor any agency

thereof, nor The Regents of the University of California, nor any of their employees, makes any warranty, express

or implied, or assumes any legal responsibility for the accuracy, completeness, or usefulness of any information,

apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights.

Reference herein to any specific commercial product, process, or service by its trade name, trademark,

manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or

favoring by the United States Government or any agency thereof, or The Regents of the University of California.

The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States

Government or any agency thereof, or The Regents of the University of California.

Ernest Orlando Lawrence Berkeley National Laboratory is an equal opportunity employer.

Copyright Notice

This manuscript has been authored by an author at Lawrence Berkeley National Laboratory under Contract No. DE-

AC02-05CH11231 with the U.S. Department of Energy. The U.S. Government retains, and the publisher, by

accepting the article for publication, acknowledges, that the U.S. Government retains a non-exclusive, paid-up,

irrevocable, worldwide license to publish or reproduce the published form of this manuscript, or allow others to do

so, for U.S. Government purposes.

March 2022 www.seeaction.energy.gov iv

Table of Contents

Acknowledgments ............................................................................................................................................. iii

Disclaimer .......................................................................................................................................................... iii

Copyright Notice ................................................................................................................................................ iii

List of Figures ...................................................................................................................................................... v

List of Tables ...................................................................................................................................................... vi

Executive Summary .........................................................................................................................................ES-1

Loan and borrower characteristics ...................................................................................................................ES-1

Loan performance ............................................................................................................................................ ES-1

Performance compared to other financial products ........................................................................................ES-2

1. Introduction .............................................................................................................................................. 1

2. Studied energy efficiency loan portfolios ................................................................................................... 1

2.1. Program overviews ..................................................................................................................................... 2

2.2. Descriptive statistics ................................................................................................................................... 4

2.2.1. Loan characteristics ...................................................................................................................... 4

2.2.2. Borrower characteristics .............................................................................................................. 8

3. Performance analysis ............................................................................................................................... 11

3.1. Methodology ............................................................................................................................................ 11

3.2. Findings ..................................................................................................................................................... 12

3.2.1. Delinquency and loss analysis .................................................................................................... 12

3.2.2. Prepayment ................................................................................................................................ 18

3.2.3. Regression analysis ..................................................................................................................... 18

4. Comparators ............................................................................................................................................ 20

4.1. Methodology ............................................................................................................................................ 20

4.2. Findings ..................................................................................................................................................... 22

5. Conclusions .............................................................................................................................................. 24

6. Areas for future work ............................................................................................................................... 25

References ........................................................................................................................................................ 27

Appendix A: Regression results ....................................................................................................................... A-1

Appendix B: Participation by CRA income bin ................................................................................................ 2B-1

March 2022 www.seeaction.energy.gov v

List of Figures

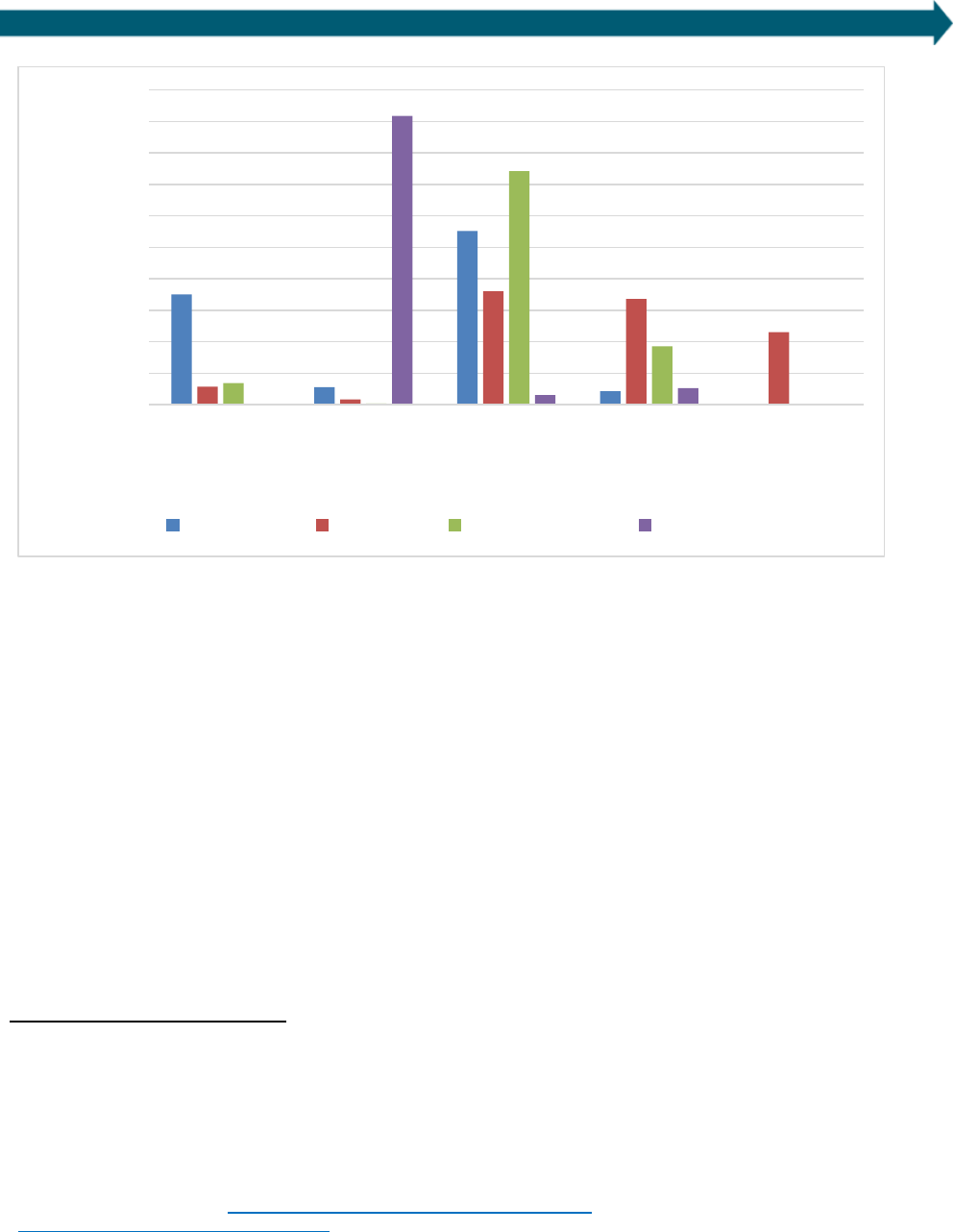

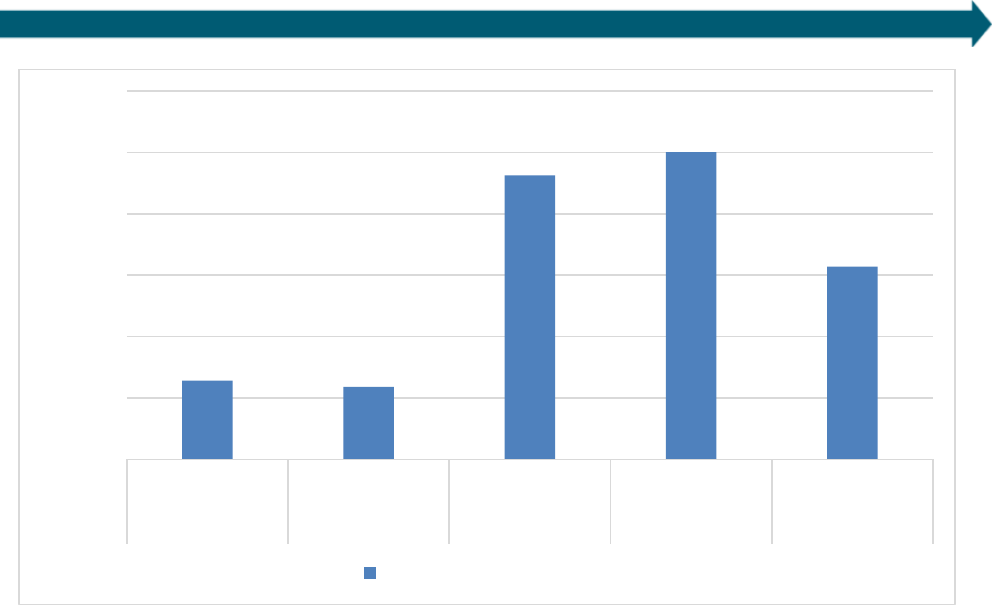

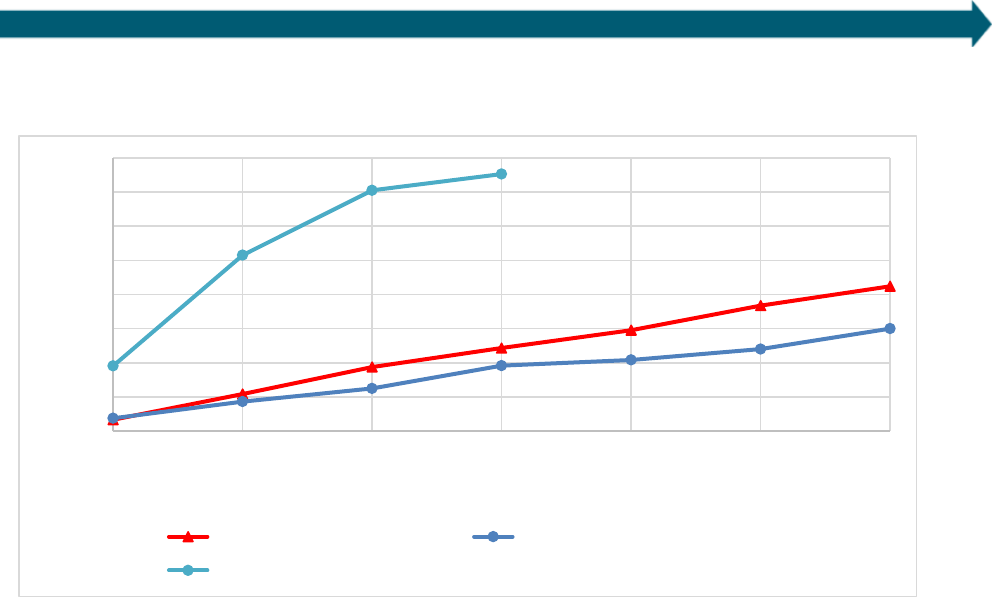

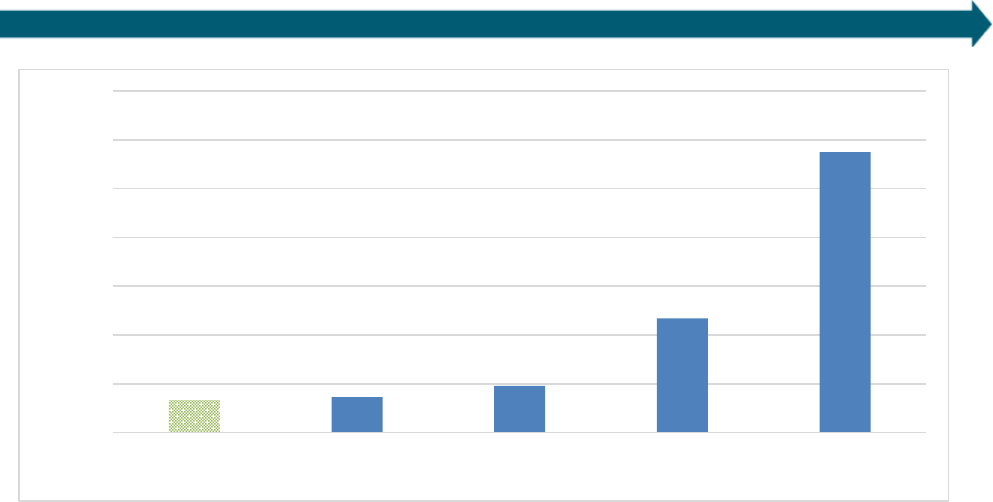

Figure ES1. Delinquency rates, energy efficiency loans and comparators ............................................................... ES-2

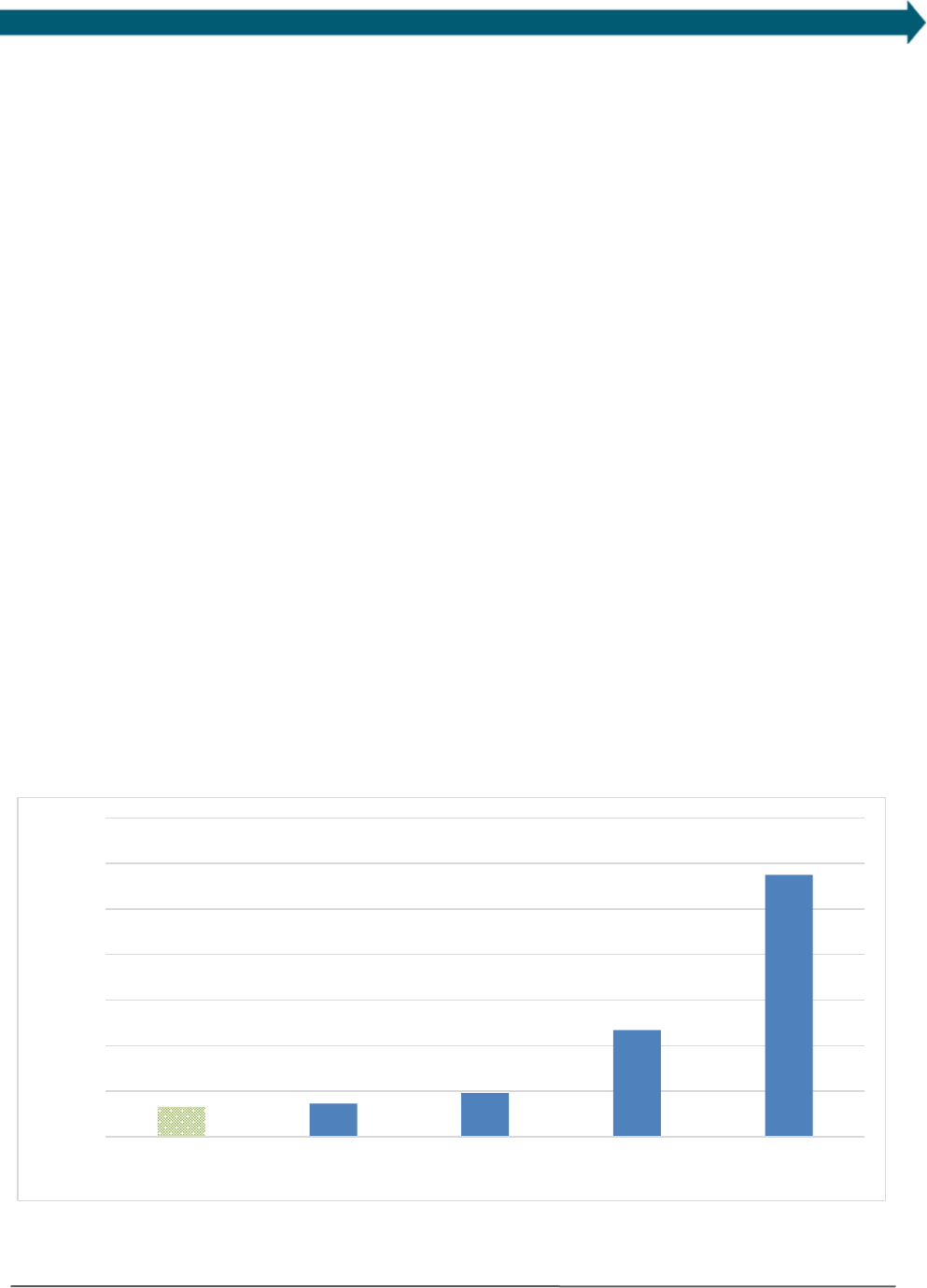

Figure 1. Loan volumes by program and vintage ........................................................................................................... 2

Figure 2. Participation by principal amount bin ............................................................................................................ 4

Figure 3. Participation by monthly payment amount .................................................................................................6

Figure 4. Share of portfolio participants with different loan terms .............................................................................. 7

Figure 5. Participation by interest rate .......................................................................................................................... 8

Figure 6. Participant incomes (by AMI bin) for three portfolios .................................................................................. 10

Figure 7. Participation in four efficiency financing programs by credit score bin ....................................................... 11

Figure 8. Delinquency rates by program ..................................................................................................................... 13

Figure 9. Cumulative gross loss rates by program and years of seasoning ................................................................. 14

Figure 10. Delinquency (share of outstanding loans) by credit score bin ................................................................... 15

Figure 11. Cumulative gross loss by credit score bin ................................................................................................... 15

Figure 13. Cumulative gross loss rates by AMI band ................................................................................................... 17

Figure 14. Delinquency rates, energy efficiency loans and comparators .................................................................... 22

Figure 15. Cumulative loss rates for, energy efficiency loans (gross) and KBRA Prime Auto (net) and Tier 1

Consumer Loans (net) .................................................................................................................................................. 23

Figure 16. Annualized loss rates, EE loans and comparators ...................................................................................... 24

Figure 17. Participation by CRA income bin .............................................................................................................. B-1

Figure 12. Delinquency (share of outstanding loans) by program and AMI band........................................................ 16

March 2022 www.seeaction.energy.gov vi

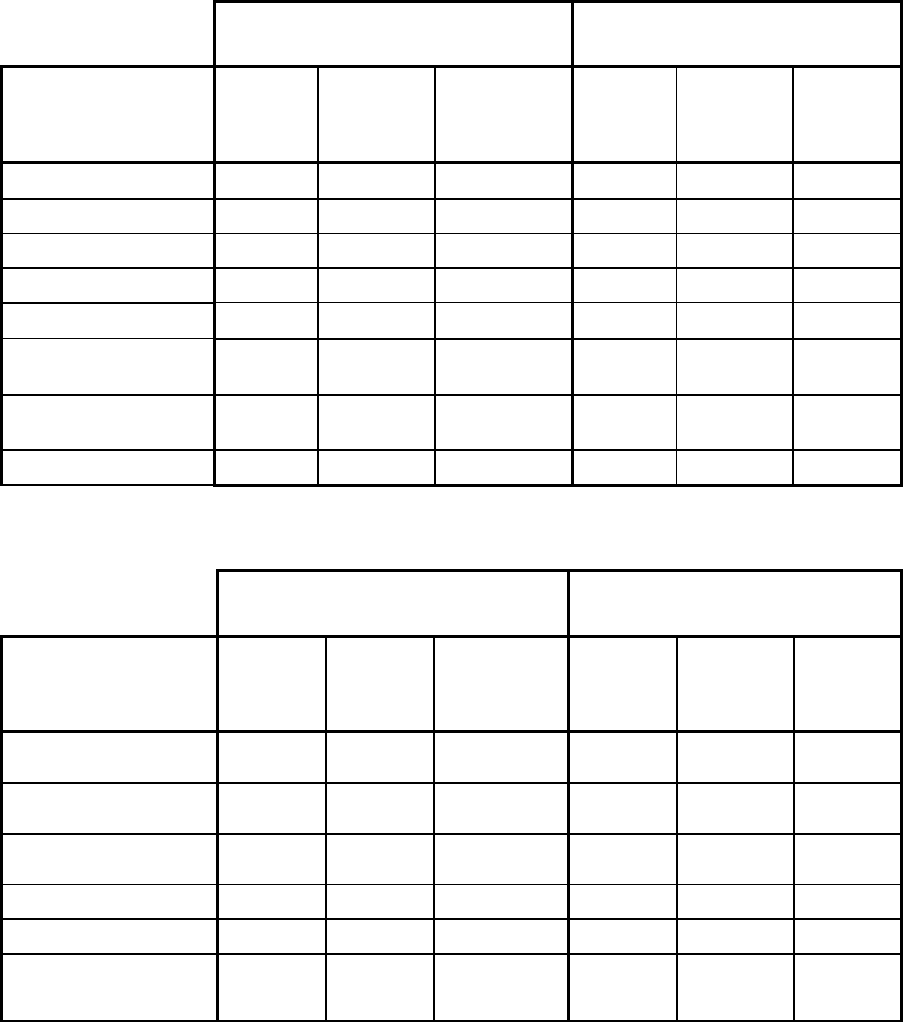

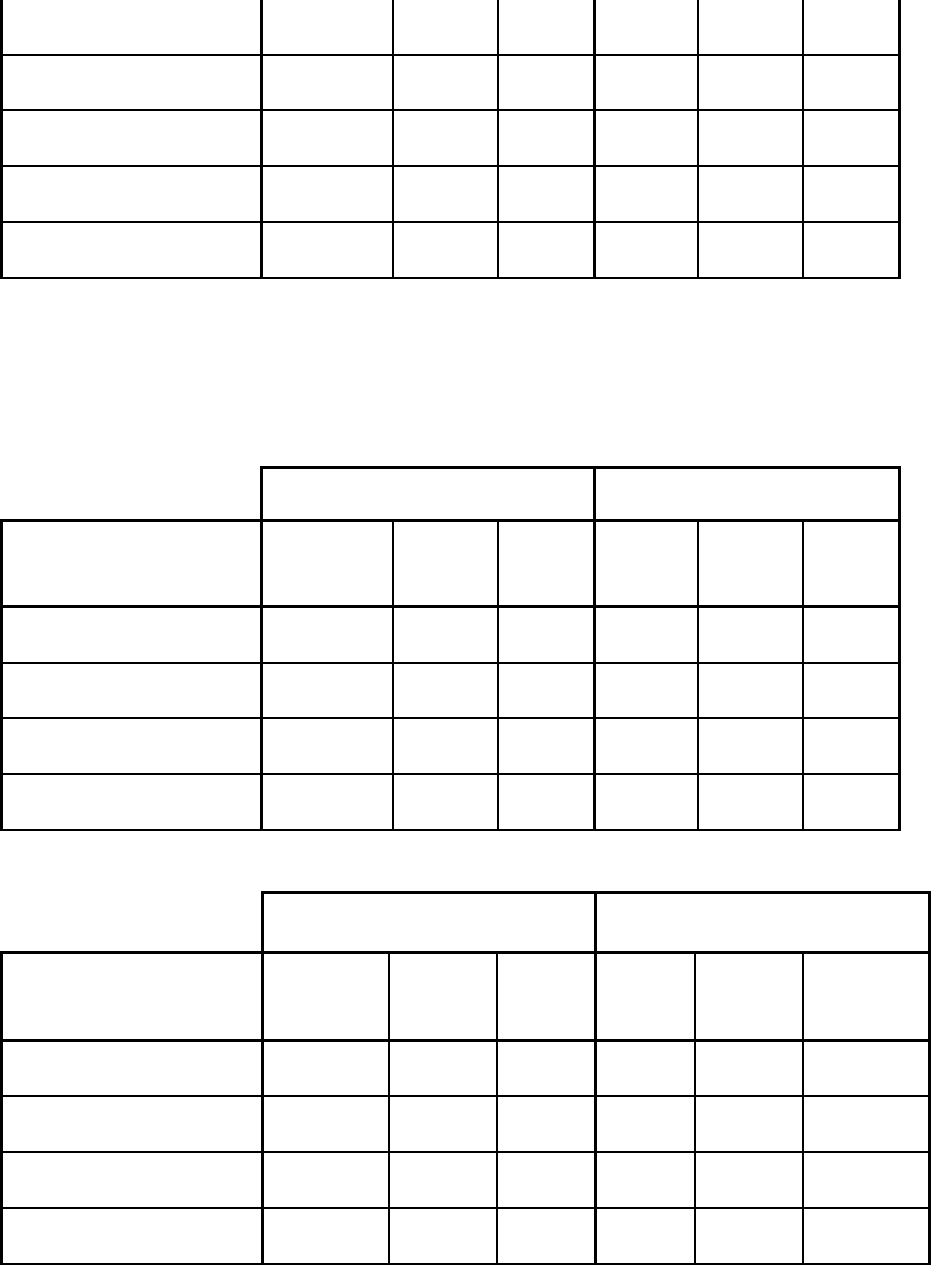

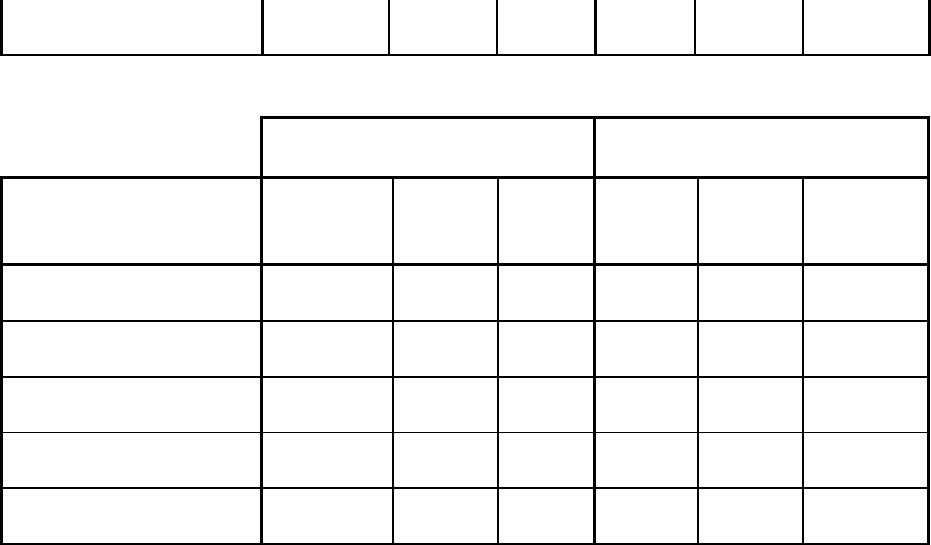

List of Tables

Table 1. Description of the loan portfolios studied ....................................................................................................... 2

Table 2. Program portfolios included in this analysis .................................................................................................... 3

Table 3. Average and median principal amounts, monthly payments, terms, and interest rates ................................ 5

Table 4. Average and median borrower characteristics ................................................................................................ 9

Table A-1. Regression output for all loan portfolios combined (n=51,041) .............................................................. A-1

Table A-2. Regression output for all loan portfolios with income (n+36,288) .......................................................... A-1

Table A-3. Regression output for Michigan Saves (n=14,905) ................................................................................... A-2

Table A-4. Regression output for CT Smart-E (n=3,166) ............................................................................................ A-2

Table A-5. Regression output for Keystone HELP (n=14,753) .................................................................................... A-3

Table A-6. Regression output for NYSERDA Smart Energy (n=14,176) ...................................................................... A-3

Table A-7. Regression output for NYSERDA On-Bill Recovery (n=3,849) ................................................................... A-4

March 2022 www.seeaction.energy.gov ES-1

Executive Summary

This report reviews and documents the financial performance of four large and long-running residential energy

efficiency financing programs. The analysis presented will inform potential capital providers, lenders, and program

administrators and help them assess the likely outcomes and risks associated with energy efficiency lending.

Anecdotally, performance of energy efficiency lending is generally understood to be strong, but data on energy

efficiency loan performance has not been readily available. The data made available in this report significantly

expand the public evidence base.

This report reviews loan performance data from four programs:

• The Connecticut Green Bank (CGB)’s Smart-E Loan program, which began issuing loans in 2013;

• The Keystone HELP program run through the Pennsylvania Treasury, which began issuing loans in 2006;

• The Michigan Saves loan program, which began issuing loans in 2010; and

• The New York State Energy Research and Development Agency (NYSERDA)’s loan programs, which began

issuing loans in 2010.

Loan and borrower characteristics

The average loan across the four studied portfolios (52,511 energy efficiency-only loans) has the following

characteristics:

• A principal amount of $9,137;

• A loan term of 121 months (just over ten years);

• An average seasoning (i.e., time since a loan was issued) of 4.5 years;

• An interest rate of 5.0%;

• A monthly payment amount of $93; and

• Is unsecured.

1

While there is some variation across programs, in general the loans are relatively similar along these parameters.

Borrowers in these programs have relatively high credit scores, concentrated in the 660-780 range with an average

of 740. The average borrower lives in a census tract with a median household income between 80% and 100% of

the median income in its metropolitan statistical area. Borrower characteristics are also comparable across the

four programs.

Loan performance

Our data document each pool’s delinquency and loss status as of a specific date (March 2020 for NYSERDA and

Smart-E, December 2019 for Michigan Saves, and September 2017 for Keystone HELP). Across the four portfolios:

• The 30-day delinquency rate – the share of outstanding loan dollars that are at least 30 days delinquent –

is 1.57% (the 60-day delinquency rates is 0.62%, and the 90-day delinquency rate is 0.21%).

1

In some on-bill lending programs (including both Michigan Saves’ and NYSERDA’s on-bill programs), nonpayment could result in disconnection

of the participant’s power service. Although some may refer to disconnection as “security” for these loans since it could incentivize repayment,

technically secured loans carry the potential loss of some form of collateral (e.g., a car or a home); this both incentivizes repayment and also

helps to make the lender whole in case of a loss. Disconnection would not help make a lender whole after a loss. On-bill loans comprise only a

small subset of the loans in the portfolios.

March 2022 www.seeaction.energy.gov ES-2

• Losses (charge offs) are highest early in loan lifetimes and decline later, a common finding for consumer

loans. The pooled portfolios lost 2.1% of the principal by year 2, 3.3% by year 4, 4.5% by year 6, and 5.1%

by year 8.

Regression analysis identifies features of loans and borrowers that are associated with strong loan performance:

• Borrower credit scores stand out: all else equal (e.g., same interest rate, loan age, and borrower income),

increasing borrower credit score by 100 lowers the odds that a given loan is 30 days delinquent by 1.06

percentage points and the odds that a given loan is charged off by 5.81 percentage points.

• Income metrics (the income of the census tract in which the borrower lives, as well as household income

available for one portfolio) are also associated with loan performance; however, this association is not

nearly as strong as that with credit score, demonstrating that credit score is a better predictor of loan

performance than income.

Performance compared to other financial products

The delinquency and loss rates of loans in the studied energy efficiency loan portfolios are low compared with

unsecured consumer loans and are comparable to the rates for prime auto loans, which are secured by the

vehicles (see Figure ES1). This strong performance may be supported by utility bill savings resulting from the

financed efficiency projects or also may in part reflect differences in borrower and loan characteristics between

the efficiency loans and comparators. Regardless, the data provide the most comprehensive evidence to date that

lenders and capital providers can expect energy efficiency loans—at least those from well-designed and

administered programs such as those studied here— to perform well.

These findings show that financial institutions can market energy efficiency improvements to their customers and

lend them the money they need for those projects at low risk, while creating a more efficient building stock. The

data show that households from low- and moderate-income areas participate in these programs and that high-

credit borrowers in these areas repay at a strong rate, suggesting efficiency financing could support policy goals

related to equitable access (e.g., Justice 40 goals and Community Reinvestment Act compliance requirements).

This analysis can inform the design of credit enhancement mechanisms, such as loan loss reserves, at the federal

or state level—for example, by setting loan performance expectations to help size financial outlays — that could

help encourage financial institutions to increase energy efficiency lending.

Figure ES1. Delinquency rates, energy efficiency loans, and comparators

0%

1%

2%

3%

4%

5%

6%

7%

Pooled EE loans, all

programs

Auto loans, prime

only (KBRA)

Non-credit card cons

loans (Fed)

Consumer loans, with

credit (Fed)

Tier 1 consumer loans

(KBRA)

Annualized Gross Loss Rates

March 2022 www.seeaction.energy.gov 1

1. Introduction

This report presents a detailed analysis of energy efficiency loan performance data from four large and long-

running residential programs. Although smaller-scale energy efficiency financing programs have operated for many

years, several larger programs were operating by 2010. These programs have now accrued enough historical data

to be of sufficient volume and maturity for substantive analysis.

Energy efficiency stakeholders have long theorized that borrowers in energy efficiency loan programs may have

low delinquency and loss rates. These loans might perform strongly because the projects being financed reduce

energy consumption and save borrowers money, leaving them with additional resources to repay the loans.

Another explanation may be because the types of households that participate in these programs may be low risk in

ways that traditional loan underwriting may not capture. For example, these households are investing in their

properties, thereby demonstrating that they value them, and are identifying and pursuing relatively small savings

opportunities, thereby demonstrating their careful attention to their expenditures (Zimring et al. 2013). The

analysis presented here is a first step toward testing this theory.

Capital market stakeholders are generally unfamiliar with energy efficiency loans.

2

Prior to this report, no

comprehensive, loan-level analyses of the financial performance of energy efficiency loans were publicly available.

If lenders and capital providers lack data regarding the true risks of these loans, they may ration credit (Palmer et

al. 2012), offering less desirable terms than they would if they had better information. This report provides

investors, lenders, and program administrators with data regarding the attributes of energy efficiency loans and

their performance.

Section 2 reviews the four energy efficiency programs studied and presents a detailed description of the loan

portfolios. Section 3 reviews the performance of these portfolios in terms of delinquency rates, charge-off rates,

and prepayment. Section 4 compares their performance to that of other financing asset classes to put the report’s

findings in context. Section 5 concludes.

2. Studied energy efficiency loan portfolios

Berkeley Lab obtained loan-level data for four residential energy efficiency financing portfolios: Keystone HELP,

Michigan Saves, the New York State Energy Research and Development Authority’s (NYSERDA) On-bill Recovery

Loan and Smart Energy Loan programs, and the Connecticut Green Bank’s Smart-E Loan program.

All of these programs except for Keystone HELP make loans for both energy efficiency and solar projects. Because

this report addresses loans for energy efficiency, loans that included solar PV were excluded. Furthermore, loans

made for the two technologies may not perform comparably. Berkeley Lab will address the performance of solar

loans in these portfolios in future work.

In total, the data include 52,511 loans. Due to occasional missing data, some data elements presented in this

report have fewer observations.

For three of the portfolios, Berkeley Lab was able to obtain data from program inception through the end of 2019

or beginning of 2020 (see Table 1 for specific dates for each portfolio). Notably, all data sets end before the

financial impacts of the Covid-19 pandemic began.

2

This differentiates energy efficiency loans from solar loans, which are more established in securities markets.

March 2022 www.seeaction.energy.gov 2

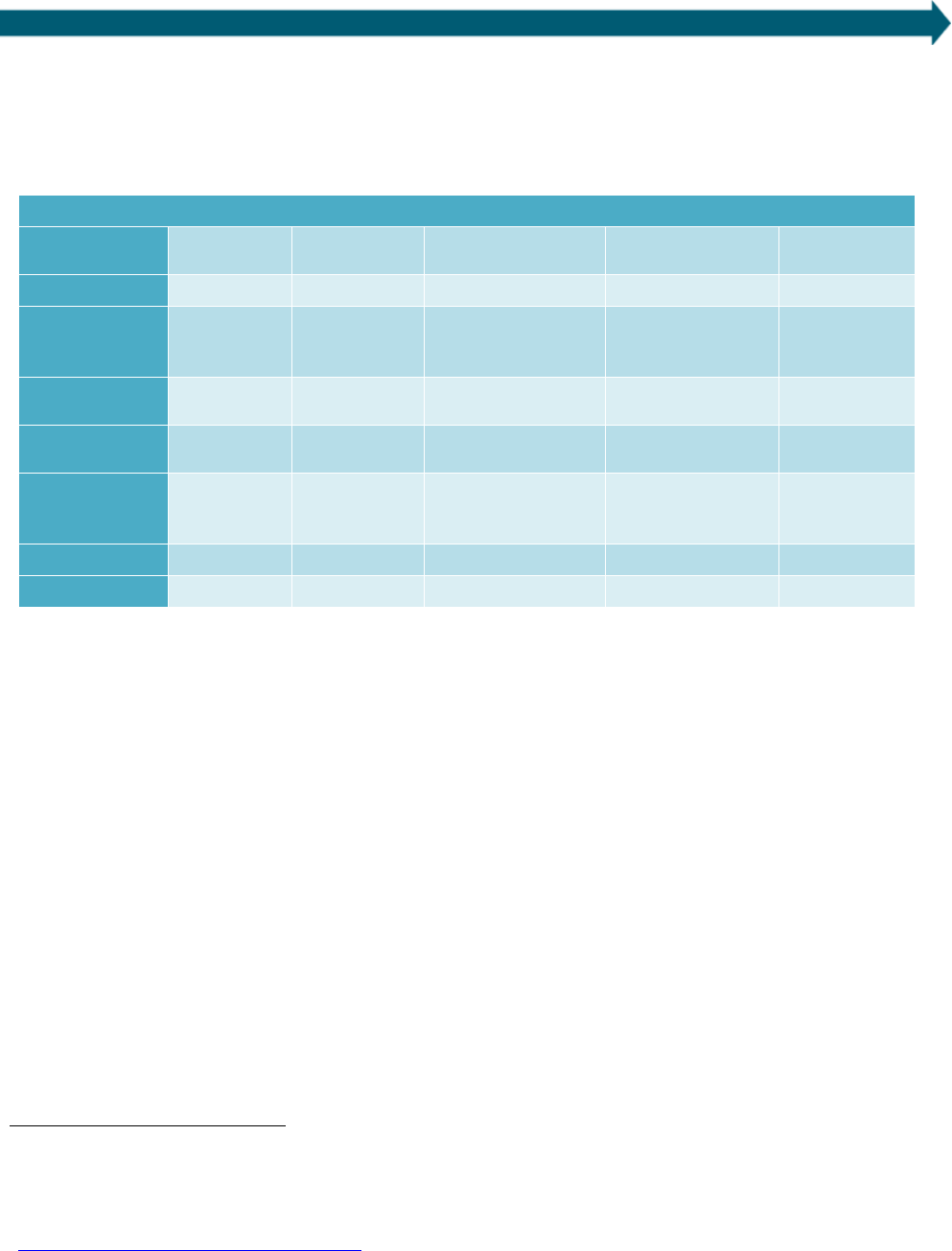

Table 1. Description of the loan portfolios studied

Program

State

Years of data

Total non-PV loans

Keystone HELP

PA

February 2006—September 2017

14,753

Michigan Saves

MI

October 2010—December 2019

16,042

NYSERDA

NY

December 2010—March 2020

18,556

Smart-E

CT

May 2013—March 2020

3,160

Fi

gure 1 shows the different program volumes by vintage, i.e., the year in which each loan was made.

F

igure 1. Loan volumes by program and vintage

For Keystone HELP, data were only available on loan status as of September 2017. Since this program began in

2006, this still represents 11 years of program loans. Keystone HELP is also the one program analyzed with

significant activity prior to the 2008 recession, and thus has navigated an economic cycle. The other programs

began after the recession. The Michigan Saves and Smart-E programs made the bulk of their loans in the last three

years of the analysis period.

2.1. Program overviews

The loan portfolios included in the analysis come from four energy efficiency loan programs: the Connecticut

Green Bank’s Smart-E Loan program, Pennsylvania’s Keystone HELP program, Michigan Saves’ programs, and the

Green Jobs, Green New York programs (comprised of the On-bill Recovery Loan and Smart Energy Loan) of the

New York State Energy & Research Development Authority (NYSERDA). See Table 2.

March 2022 www.seeaction.energy.gov 3

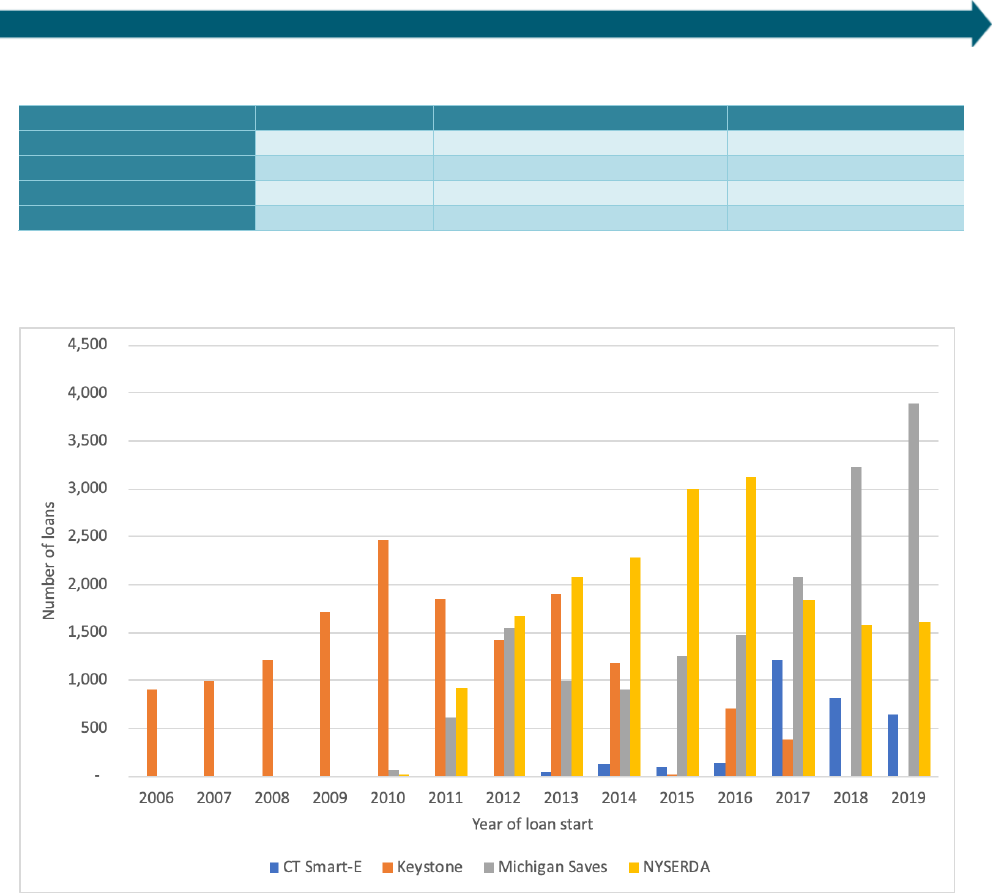

T

able 2. Program portfolios included in this analysis

Program

Smart-E

Keystone HELP

Michigan Saves

Green Jobs Green New York

Program administrator (PA)

Connecticut Green Bank (CGB) and Inclusive

Prosperity Capital (IPC)

AFC First

a

Michigan Saves

NYSERDA

Description of PA

Quasi-governmental green bank increasing flow

of private capital to markets that energize the

green economy

Private energy efficiency financing

company

Nonprofit green bank funding

clean energy

State authority advancing clean energy

innovation and investments

Lender (entity extending program

loans)

13 local financial institutions

b

AFC First

a

7 local financial institutions

b

NYSERDA

Underwriting criteria

CGB/IPC ask lenders to use their standard

practice: FICO (min. 640 or 580), Debt-to-

income (DTI) (max. 50% or 45%), no bankruptcy

in last 4 to 7 years, income verification

c

Min. credit 640

Max. DTI 50% (42% for loans >$25K), no

bankruptcy for 5 years

Min. credit 600

Max. DTI 50%, no bankruptcy for

12 months; for on-bill, 12 months

on-time utility bill payment

Min. credit score 540

Max. DTI depends on credit score, no

bankruptcy for 2 years, 12 months on

time mortgage payments

Loan underwriter

13 local financial institutions

b

AFC First

a

7 local financial institutions

b

Slipstream

Structure (on- vs off-bill, secured

d

or unsecured)

Unsecured, off-bill loans

Unsecured, off-bill loans

Unsecured, on- and off-bill loans

Unsecured, on- and off-bill loans

Credit enhancements (CE) to

lenders (does not include CEs for

secondary market loan sales)

Loan loss reserve (second loss, at the portfolio

level)

Loss reserves were provided through

various Pennsylvania state agencies and

grants

Loan loss reserve, and utility

capital from one publicly-owned

utility

None

Source of capital

Local financial institutions

Pennsylvania Treasury, AFC First,

securitization proceeds, local bank loan

pool

Local financial institutions,

municipal utility capital (for

Holland on-bill program)

Regional Greenhouse Gas Initiative

funds

e

, securitization proceeds

Federal funds used

American Recovery and Reinvestment Act

(ARRA) funds for loan loss reserve and interest

rate buydowns at different points in the

program

ARRA funds provided loss reserves and

rate buydown funds for some of the

program years

ARRA funds provided the loan loss

reserve

None

a

The program administration changed in 2015 upon AFC First’s acquisition by Renew Financial. AFC First was also lender and underwriter for the program. The National Energy

Improvement Fund (NEIF), a successor run by AFC First’s management, is now providing administration services for a portion of the portfolio.

b

For residential program participants.

c

Participating lenders can use standard or credit-challenged term sheets; underwriting thresholds depend on which is used.

d

In some on-bill lending programs (including both Michigan Saves’ and NYSERDA’s on-bill programs), nonpayment could result in disconnection of the participant’s power service.

Although some may refer to disconnection as “security” for these loans since it could incentivize repayment, technically secured loans carry the potential loss of some form of collateral

(e.g., a car or a home); this both incentivizes repayment and also helps to make the lender whole in case of a loss. Disconnection would not help make a lender whole after a loss.

e

See: https://www.rggi.org.

March 2022 www.seeaction.energy.gov 4

2.2. Descriptive statistics

This section describes several characteristics of the studied efficiency loan program portfolios: four properties of

the loans themselves (loan tenors, principal amounts, monthly payment amounts, and interest rates) and two

characteristics of the participants (incomes and credit scores). Each of the characteristics could impact loan

repayment performance; Section 3 explores their relationships with loan performance.

2.2.1. Loan characteristics

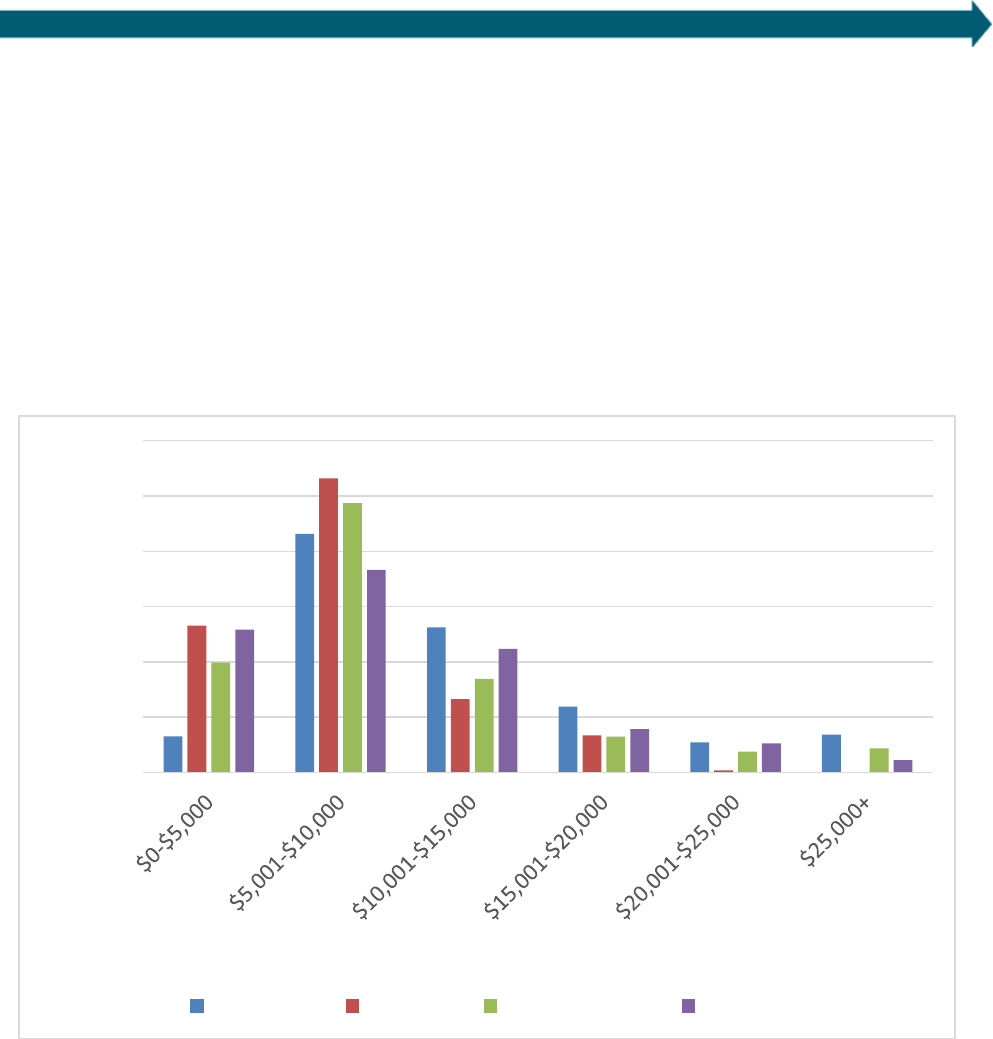

Figure 2 summarizes the principal amounts of loans issued by each program. The amounts participants are

borrowing through these portfolios is concentrated in the $5,000 to $10,000 range (see averages and medians in

Table 3).

Figure 2: Participation by principal amount bin

0%

10%

20%

30%

40%

50%

60%

% of loans

Principal amount bin

CT Smart-E Keystone Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 5

Table 3. Average and median principal amounts, monthly payments, terms, and interest rates

Maintaining loan program data to facilitate performance analysis

To expand the public evidence base on the performance of energy efficiency loans, Berkeley Lab approached a

number of energy efficiency loan programs for this analysis. The four programs that shared data were very

cooperative, and several other programs were willing but ultimately unable to share.

3

A common issue that makes data access challenging is that all the necessary loan data are often not maintained

by a single entity. It is common for different entities to perform different functions – e.g., project approval, loan

origination/underwriting, loan servicing. In some cases, the data on each function reside in different systems.

While there is generally some common identifier (such as a loan ID) that could be used to associate the data, the

level of effort to do so can be significant. By proactively integrating these systems where possible to maintain

consolidated data for analysis, program administrators can help educate and motivate capital providers and lower

the cost of capital for these programs in the future.

Moreover, some programs – including Michigan Saves, Smart-E, and many others – partner with local lenders

(most often credit unions and banks) that make their own loans and maintain their own data. Michigan Saves and

the Connecticut Green Bank demonstrate that some programs gather and consolidate data from multiple lenders

to enable analysis. Where possible, other programs that use many local lenders can help facilitate additional

analysis by gathering their loan data in one central system.

Finally, most if not all programs do not maintain their data in a manner that easily enables time series analysis.

This report studies delinquency and charge-off rates at one moment in time for each program. Programs that can

assemble and maintain a monthly time series of loan status could support more detailed and powerful statistical

analysis.

Berkeley Lab’s report Energy Efficiency Finance Programs: Use-case Analysis to Define Data Needs and

Guidelines provides recommendations on maintaining data to facilitate loan performance analysis; see SEE

Action Network (2014a).

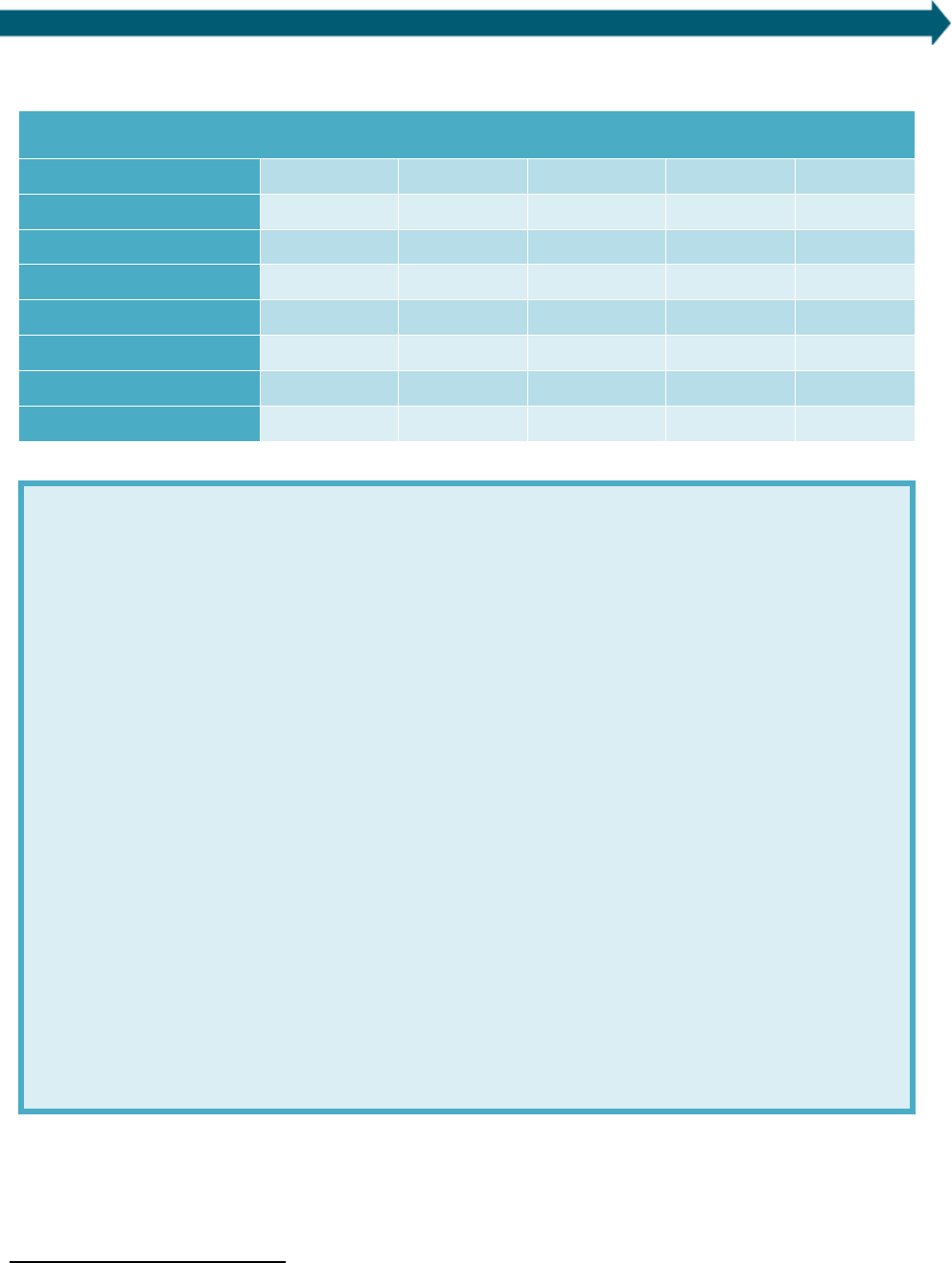

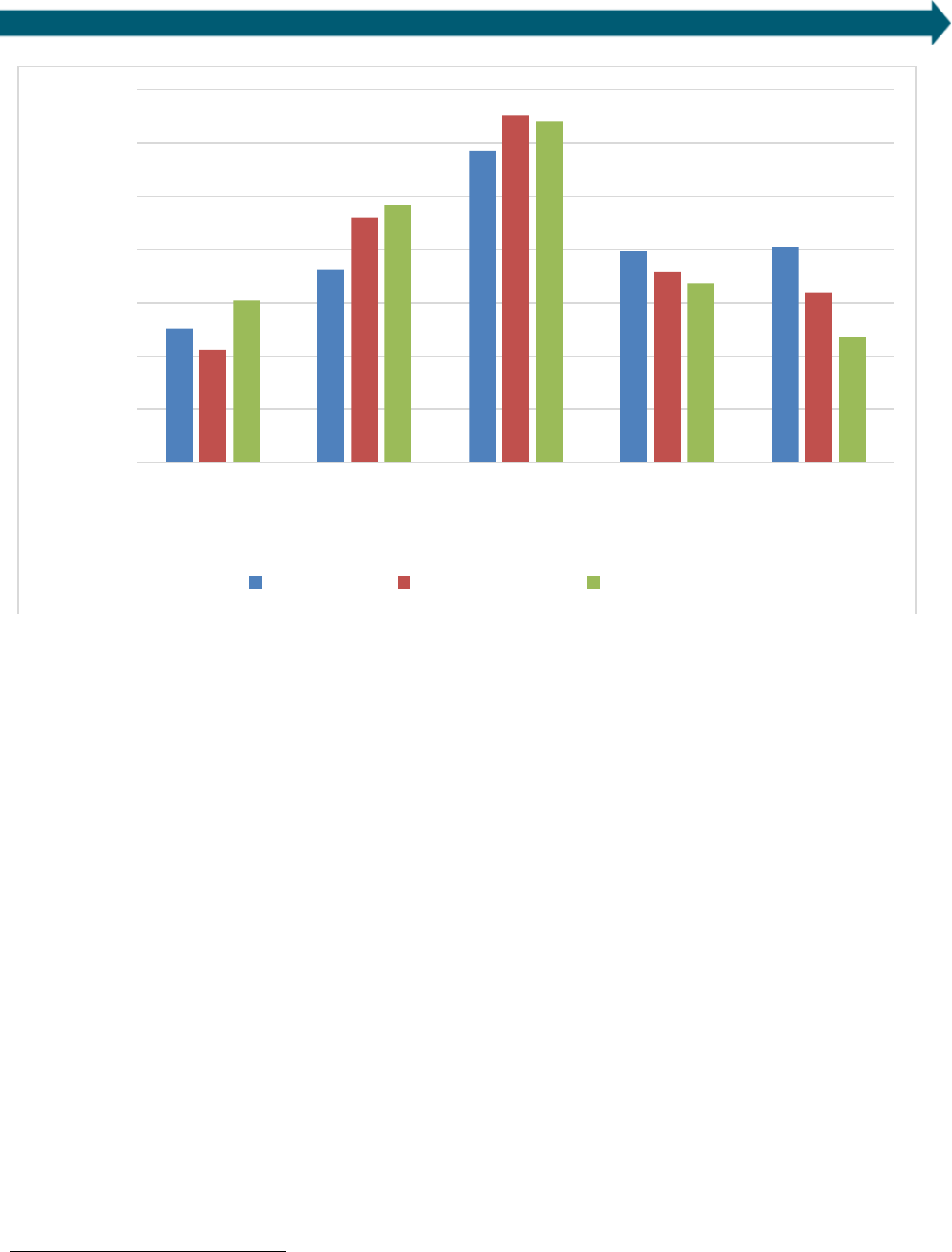

Monthly payments demonstrate the ongoing cash flow burden that a loan presents for participants. Figure 3

presents monthly loan payments for each program. Across the portfolios included in the study, monthly payments

mostly fall into the $51 to $100 per month range. The distribution of monthly payment sizes between Michigan

Saves and Keystone varies little. Compared to the other portfolios, the NYSERDA portfolio has a higher share of

3

The four programs analyzed are among the largest and oldest in the U.S. There are dozens of other energy efficiency financing programs in the

U.S., but few programs offer the high-volume, long-term data (and were willing to share their data), that the four programs provided.

Smart-E

Keystone

Michigan

Saves

NYSERDA

All

programs

Average principal amount

$12,239

$7,594

$9,679

$9,366

$9,137

Median principal amount

$10,094

$7,000

$7,801

$7,971

$7,661

Average monthly payment

$160

$90

$101

$76

$93

Median monthly payment

$139

$80

$85

$65

$80

Average term (months)

92

93

100

166

121

Median term (months)

84

120

120

180

120

Average interest rate

3.5%

6.7%

5.1%

3.8%

5.0%

Median interest rate

4.5%

7.0%

5.0%

3.5%

5.0%

March 2022 www.seeaction.energy.gov 6

loans with monthly payments under $50 per month (37%). The CT Smart-E portfolio has a higher share of loans

with monthly payments above $150 per month (44%). Smart-E principal amounts and area median incomes are

also higher than other programs, suggesting that (1) Connecticut is likely the highest-cost market and (2)

Connecticut borrowers may qualify for larger loans due to their incomes.

F

igure 3. Participation by monthly payment amount

Lo

an term (or tenor) refers to the amount of time until a loan matures. Longer term loans are riskier for lenders

but result in lower monthly payments for borrowers because the repayment is spread over a longer period.

Programs generally offer a limited number of terms (e.g., five years, seven years) and the terms offered may

change over time. Program administrators provided terms for each loan. Loan terms for Keystone, Michigan Saves,

and CT Smart-E are almost entirely ten years (120 months) or less, with terms for over half of loans in each of

those portfolios falling between 61 and 120 months. NYSERDA is the outlier: 84% of their loan terms are 15 years

(180 months), which explains the relatively small monthly payments for NYSERDA loans in Figure 3. The median

loan term across all four portfolios is ten years (120 months) (see Table 3).

0%

10%

20%

30%

40%

50%

60%

<$50 $51-$100 $101-$150 $151-$200 >$200

% of loans

Monthly payment bins

CT Smart-E Keystone Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 7

F

igure 4. Share of portfolio participants with different loan terms

Another factor that impacts payment amounts is the interest rate charged on a loan. Interest rates vary within and

across the four programs. Rates ranged from a low of 0% to a high of 8.99%. Most fall between 4% and 6% with

most NYSERDA loans at 3.49% or 3.99% (see Figure 5). Several factors explain the differences in interest rates

across programs:

• Credit enhancements: Programs that benefit from more generous credit enhancements (such as larger

loan loss reserves) can charge lower interest rates.

• Lender requirements: Different lenders require different returns to participate in these programs. “Pure

”

pr

ivate capital providers generally require higher returns than mission-driven lenders, and programs that

lend public or utility customer dollars have more freedom to set their own rates.

• Timing: Prevailing market interest rates have been low since the Great Recession, but were at times much

higher in the past; this in part explains the higher interest rates charged by Keystone HELP.

• Promotional rates: The Smart-E program offered very low interest rates for a period of time to attract

interest in the program, which explains the large share of Smart-E loans in the first bin.

0%

20%

40%

60%

80%

100%

0-60 61-120 121-180

% of loans

Term bin (months)

CT Smart-E Keystone Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 8

F

igure 5. Participation by interest rate

2.2.2. Borrower characteristics

Participant income could impact repayment performance since households with more income have more financial

resources available to make loan payments. Each program collected participant income data differently. Keystone

HELP did not have participant income data (and this portfolio is therefore not included in any analyses that use

income data). NYSERDA reported a debt-to-income-ratio, but not a household-level income metric. The

Connecticut Smart-E Loan program reported a ratio of the median income of a household’s census tract to the area

median income (AMI). Only Michigan Saves reported actual household income. However, every program except

Keystone HELP reported the census tract in which each borrower lives. Berkeley Lab therefore was able to

calculate a common metric – the ratio of median census tract income to AMI – for all programs except Keystone

HELP (see Table 4).

4

Note that this metric describes the income of the census tract in which the home resides but

is not a household-level value.

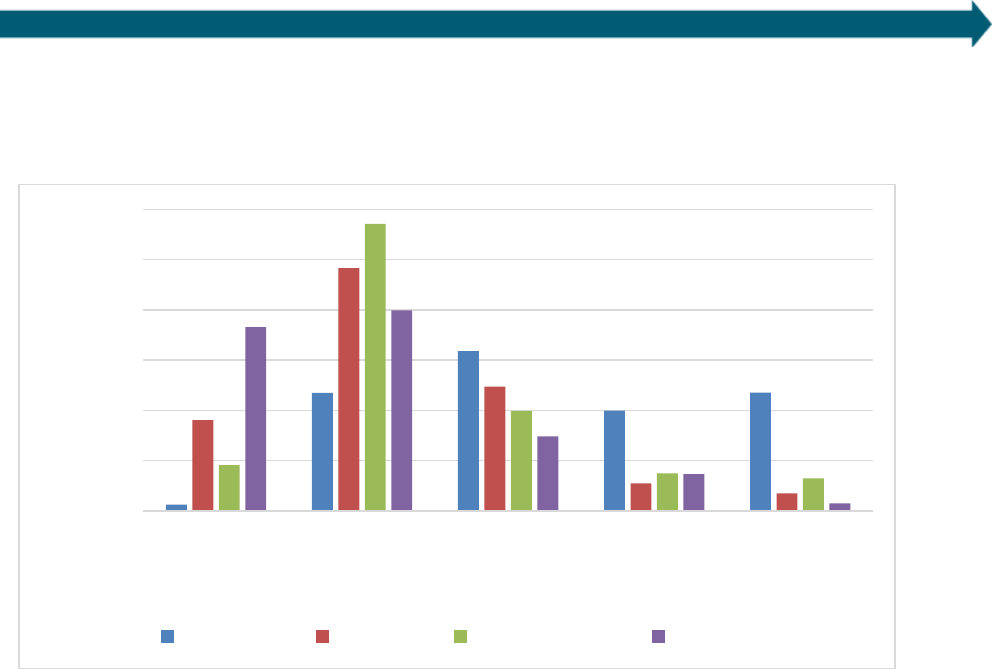

Overall, about two-thirds of participants in these programs are from census tracts where incomes are 80% of the

AMI or higher. The greatest share of participants falls into the 80%-100% AMI bin (see Figure 6). The three

portfolios have a similar distribution across the AMI bins. Overall, across programs the majority of borrowers are

from census tracts with median incomes less than the median income of their statistical area.

5

Relatively few

4

To assess the impact of income across programs in a consistent fashion, Berkeley Lab calculates census tract AMI bands for each program.

This metric is the ratio of census tract-level median household income estimates from the American Community Survey (ACS) to area median

income as defined by the Department of Housing and Urban Development (HUD). This method is consistent with Smart-E’s in the use of census-

tract level median household incomes, but differs in the source of the area median income. Smart-E used ACS Metropolitan and Micropolitan

Statistical Areas, which provided full geographic coverage for Connecticut. New York and Michigan, however, have tracts that are outside these

two types of statistical areas. The HUD area median incomes address this gap and provide county-level incomes alongside statistical area data

incomes. This analysis matches HUD and ACS vintages to the year of loan issuance to account for changes in tract and area incomes over time.

ACS income data can be found at https://www.census.gov/programs-surveys/acs/data.html. HUD income data can be found at

https://www.huduser.gov/portal/datasets/il.html. In this analysis, HUD and ACS incomes are aligned by data release year. HUD data draw on

three-year old ACS estimates for each data release (e.g., 2018 HUD data is based on 2015 ACS data). Given that the ACS incomes cover five

years (e.g., 2014-2018 for the 2018 release), they still overlap with the window of HUD incomes.

5

To see participant incomes by AMI broken into income bins used for the purposes of the Community Reinvestment Act, see Appendix B.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0%-2% 2.01%-4% 4.01%-6% 6.01%-8% 8.01%-10%

% of loans

Interest rate bin

CT Smart-E Keystone Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 9

borrowers (10-15%) in each program live in census tracts with median incomes below 60% of area median;

between 30 and 40% of borrowers in each program live in census tracts with median incomes below 80% of area

median.

6

Table 4. Average and median borrower characteristics. (Keystone HELP did not have sufficient data to determine

income metrics.)

Smart-E Keystone Michigan Saves NYSERDA All programs

Median tract

income

$89,858

$63,425

$68,593

$67,152

Median AMI

$95,260

$72,842

$75,736

$74,507

Median tract

income /

median AMI

92.6%

88.8%

85.3%

87.5%

Average tract

income

$93,210

$67,478

$77,529

$74,134

Average AMI

$98,042

$72,637

$87,404

$81,262

Average tract

income /

average AMI

95.2%

93.0%

87.3%

90.8%

Average FICO

739

751

741

729

734

Median FICO

741

754

744

740

745

6

Definitions of low-income households and areas vary, so there is no single way to characterize the share of borrowers in these programs that

are low- and moderate-income (LMI). In the energy sphere, the Low-Income Home Energy Assistance Program uses a household-level eligibility

criterion of 60% of state median income, and the Weatherization Assistance Program also relies on this criterion in some states. 10-15% of

households in the data meet this definition per area (as opposed to state) median income. HUD considers households with incomes less than

80% AMI to be low income and those less than 50% to be very low income for rental housing assistance programs and the HOME program (see

https://www.hud.gov/topics/rental_assistance/phprog

and https://www.huduser.gov/portal/datasets/home-datasets/files/2021-HOME-

IncomeLmts-Memo.pdf). The Community Redevelopment Act (CRA) designates less than 80% AMI as moderate income and less than 50% as

low income. Per Appendix B, 5-8% of borrowers in each program live in census tracts considered low income by the CRA or very low income by

HUD, while about 30-40% would be considered either low- or moderate-income by CRA and low income by HUD.

March 2022 www.seeaction.energy.gov 10

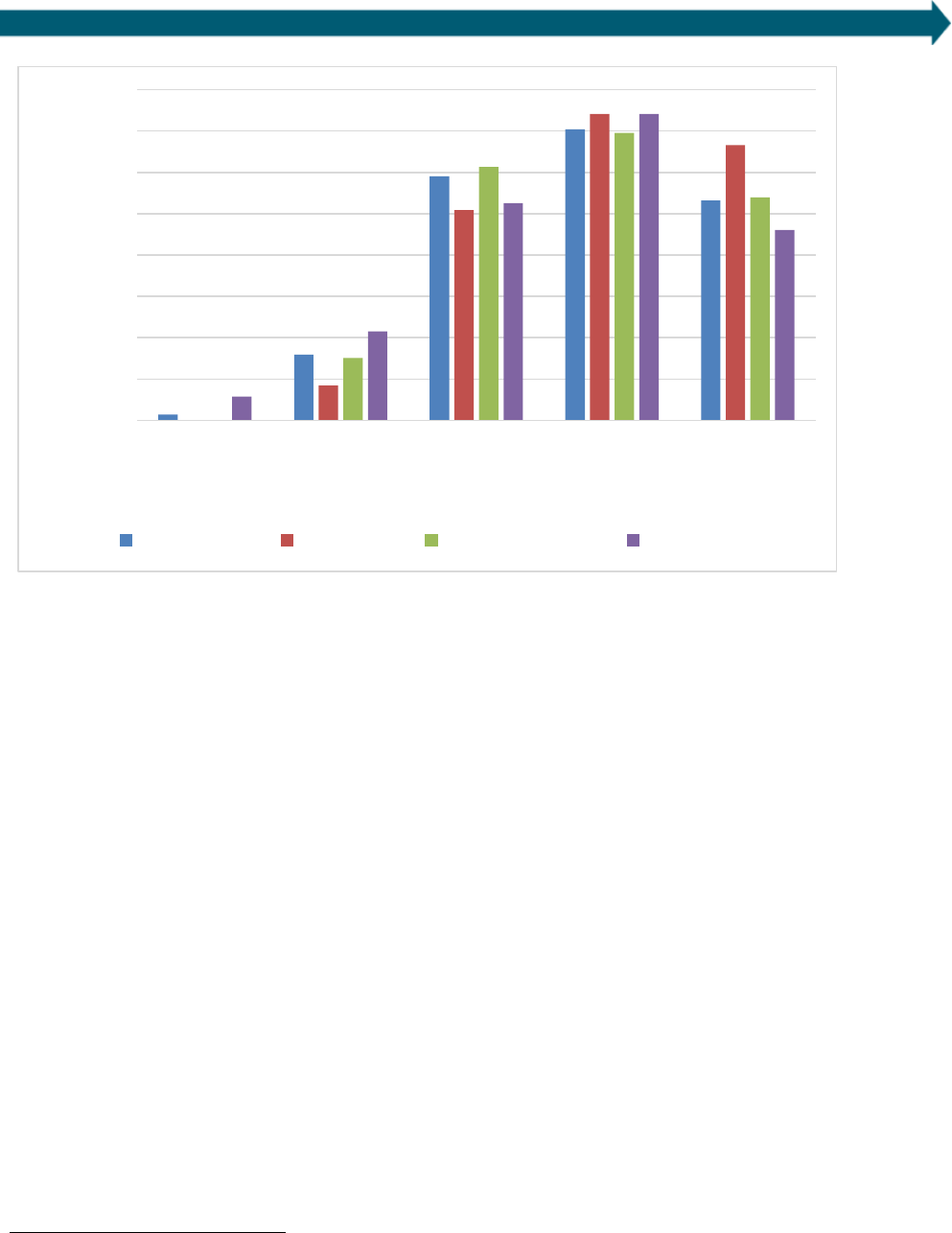

F

igure 6. Participant incomes (by AMI bin) for three portfolios

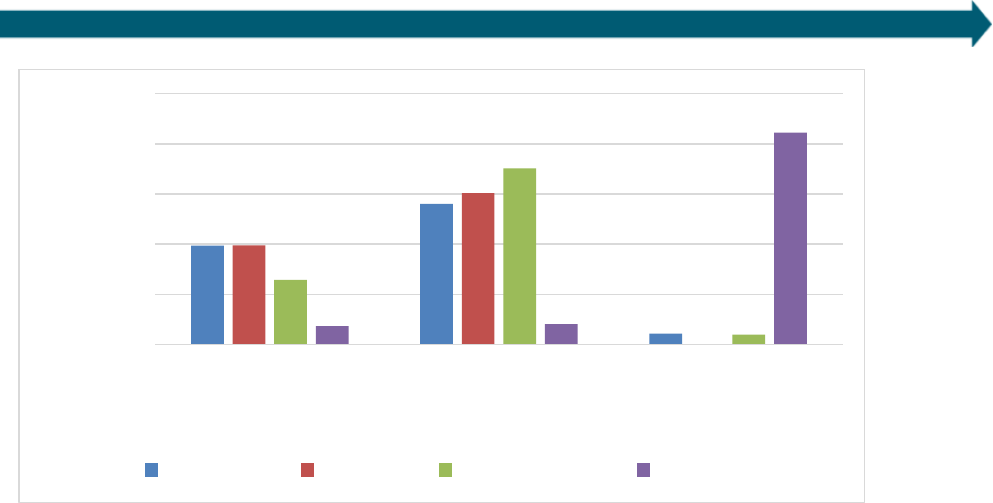

A credit score is a number designed to measure a consumer’s creditworthiness, i.e., it is used to predict the

likelihood that a borrower will fully repay their loan. The most commonly used credit score is the Fair Isaac

Corporation (or FICO) score which ranges from 300 to 850, higher numbers suggesting the borrower is more

creditworthy (see Figure 7 for more).

7

Across the four portfolios, most credit scores are high: the average credit

score is 734 with a median credit score of 745. Importantly, these programs are only available to homeowners,

who as a customer segment have higher credit scores than renters (Li 2016). These scores suggest that the

likelihood that borrowers participating in these programs repay their loans in full is high.

7

Although Berkeley Lab believes that most of the reported scores are FICO scores, Michigan Saves identified one lender that reported Vantage

Scores instead. It is possible that other lenders did so as well.

0%

5%

10%

15%

20%

25%

30%

35%

<60% 60%-80% 80%-100% 100%-120% >120%

% of loans

AMI bins

CT Smart-E Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 11

F

igure 7. Participation in four efficiency financing programs by credit score bin

3. Performance analysis

3.1. Methodology

To analyze the data from all portfolios, each loan is assigned a status as either paid-off, delinquent, charged off, or

current.

The definition of charge-offs can vary across loan providers, depending on how they decide when to declare a loan

as a loss.

8

Such determinations may be made if the loan becomes seriously delinquent, but also for other reasons

(e.g., bankruptcy, death of a borrower, etc.). Many lenders automatically declare a loan as charged off if it reaches

a certain delinquency status, often 120 days. This study considers a loan charged off if either (a) the program

identified a loan as charged off or (b) the loan was 120 days or more delinquent. This definition of charge-off is

consistent with those used by comparator products later in this study (auto loans and consumer loans – see

Section 4), to the extent that they specify clear definitions.

Loan providers generally report delinquencies in bins that denote the number of days that have passed without

payment since a payment due date (e.g., 30, 60, 90, 120 days). Since the definition of charge-off covers loans 120

days or more delinquent, delinquent loans are those that have not been paid 30-120 days after the payment due

date.

Customers may pay their loans off at or before the original maturity date. A loan is paid-in-full if a program

identifies it as such or the remaining balance is zero.

8

When a lender declares a loan to be charged off, it declares the loan as a loss on its accounts and often transfers collection responsibilities to a

collection agency. If the collection agency reports to credit bureaus, the loan will now appear as a charge-off on a borrower’s credit report. The

borrower is still obliged to repay the loan.

0%

5%

10%

15%

20%

25%

30%

35%

40%

300-600 601-660 661-720 721-780 781-850

% of loans

Credit score bin

CT Smart-E Keystone Michigan Saves NYSERDA

March 2022 www.seeaction.energy.gov 12

A loan is current if it is neither charged off, delinquent, nor paid-in full. Current loans are actively in repayment but

not in any form of distress.

Delinquency rates presented in this report are the share of active (not charged off and not paid off) loans that are

30-120 days behind on payments. The delinquency rate can be expressed both in terms of the total remaining

balance of loans that are delinquent and the number of delinquent loans.

=

=

For example, if a loan portfolio has $1,000,000 in outstanding principal balance from 1,000 active loans and 60 of

those loans with a total of $50,000 in outstanding principal balance are 30-120 days delinquent, then the portfolio

would have a dollar-based delinquency rate of 5% ($50,000/$1,000,000) and count-based delinquency rate of 6%

(60/1,000).

The cumulative gross loss rate

9

is the total dollars charged off after some number of years for loans originated at

least that long ago (but not past their term) as a share of the original balance of those loans. The cumulative gross

loss rate can be calculated for each year of seasoning (i.e., how much time has passed since the program issued

the loan). Loans that have seasoned for five years, then, are part of the loss rate for years one through five but not

for years after five.

=

In the hypothetical portfolio with $1,000,000 in outstanding principal balance from 1,000 loans, assume that the

original loan pool was 1,050 loans (i.e. 50 have already charged off). If the original principal balance of those 1,050

loans was $2,000,000 and the 50 which were charged off totaled $40,000, then the cumulative gross loss rate

would be 2% ($40,000/$2,000,000).

Regression analyses determine the drivers of delinquency and charge-off and unpack differences in performance

across the portfolios (see Section 3.2.3 for details).

3.2. Findings

3.2.1. Delinquency and loss analysis

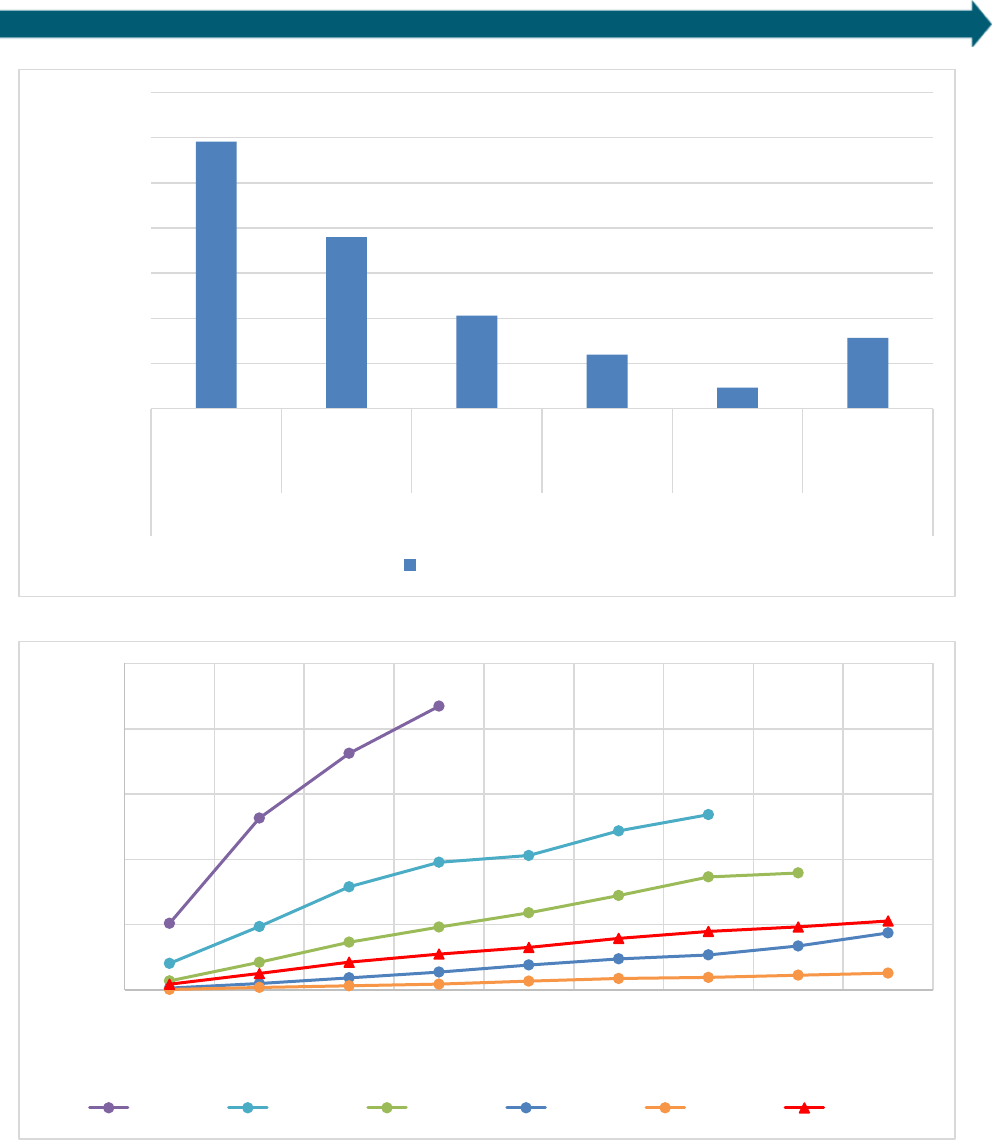

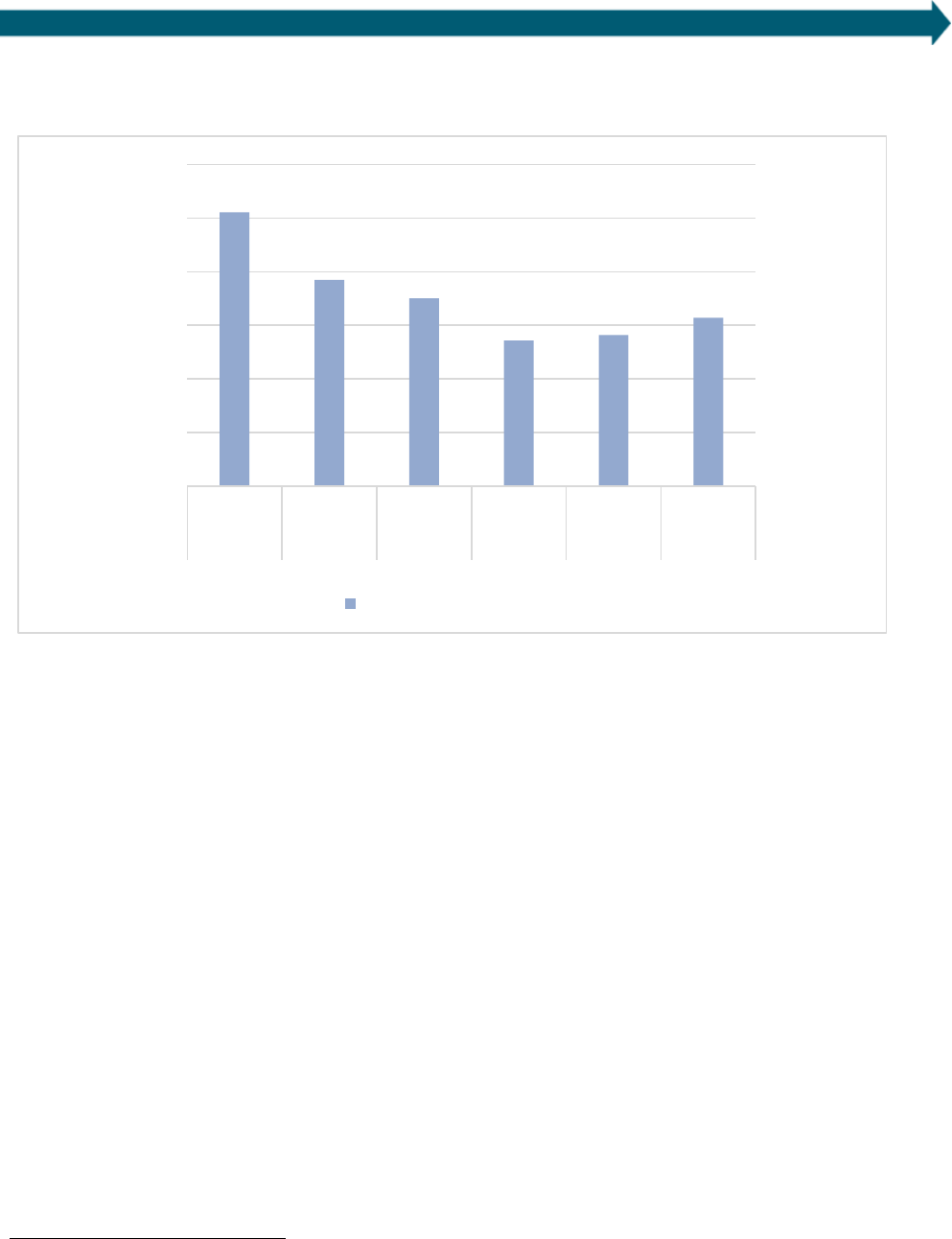

Figure 8 presents 30-120-day delinquency rates for each program. The sample sizes in this figure differ from those

in Figure 10 because the delinquency rate calculation only considers current loans and excludes any paid-off or

charged-off loans. Overall, the 30-120-day delinquency rate for loans in the four portfolios is 1.57%.

NYSERDA delinquency rates for the On-Bill Recovery Loan – an on-bill loan – are much higher than those for its

Smart Energy Loan product, explaining its high overall delinquency rate. Due to the structure of the program, any

delinquency on a utility bill also results in a delinquency on the on-bill loan. When NYSERDA on-bill loans – which

are somewhat atypical – are removed from the pool, the 30-day delinquency rate drops to 1.14% Notably,

NYSERDA on-bill loss rates are not higher than those of the off-bill Smart Energy Loan, indicating that most of these

delinquencies do eventually cure. Section 3.2.3.3 discusses this issue further. As also noted in Section 3.2.3.3, the

difference in delinquency rate between Smart-E loans and the lower-delinquency programs is not statistically

significant (Smart-E has the smallest loan count of the programs in this study).

9

As discussed in Section 4, most loan performance indices look at net losses, e.g., losses minus recoveries (any monies recovered after a loan is

charged off). Because no recovery data was available for these portfolios, this analysis reports gross losses instead of net losses.

March 2022 www.seeaction.energy.gov 13

F

igure 8. 30-120-day delinquency rates by program

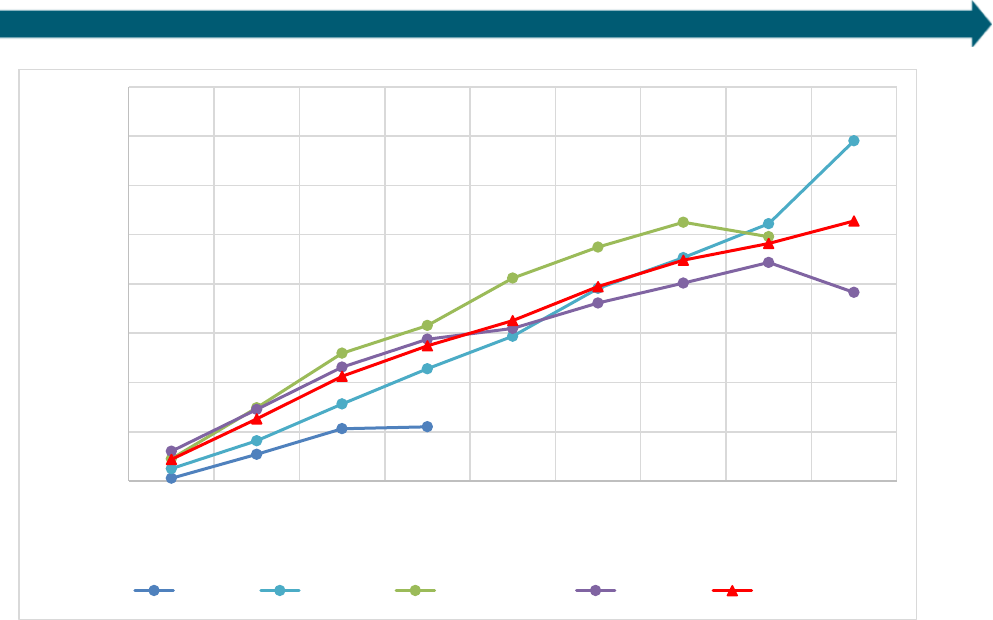

To understand how losses depend on loan seasoning, Figure 9 presents cumulative gross loss rate over time for

each program with respect to years of loan seasoning. Each data point in this figure shows the cumulative gross

loss rate since initial loan closing. Since the loss rates are cumulative, they increase over time for all four portfolios.

The loss rates are sensitive to both vintage effects and small loan pools. The number of loans that have seasoned

eight years, for example, is much smaller than the number that has seasoned two. This figure addresses this issue

by excluding loan vintages with total principal amounts under $5M, which is why some curves do not extend as far

as others. Vintage effects, such as higher loss rates for loans issued before the 2008 financial crisis could affect

Keystone loans in particular.

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

n=5485 n=10827 n=2782 n=14145 n=33239

Keystone Michigan Saves Smart-E NYSERDA Overall

Share of Outstanding Balance

Delinquency Rate (Dollars)

March 2022 www.seeaction.energy.gov 14

F

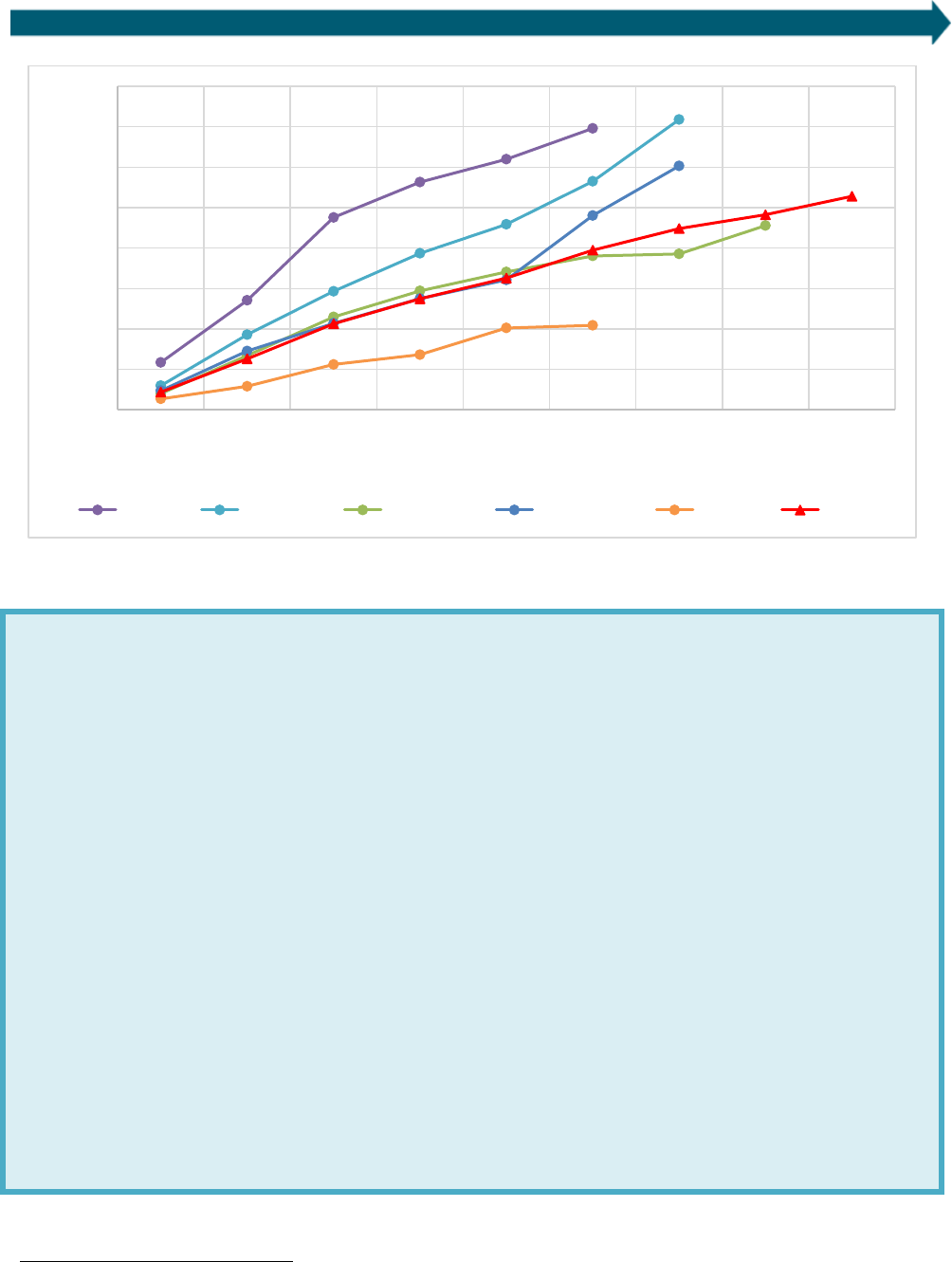

igure 9. Cumulative gross loss rates by program and years of seasoning

Close examination of Figure 9 shows that more losses occur in the early years after loan issuance than in later

years. For example, looking at the overall cumulative loss curve, losses in year 8 are 5.3%. If the loss rate was

constant over time, losses in years 2, 4, and 6 would be 1.3%, 2.6%, and 4.0% respectively. In fact, those loss rates

are 2.1%, 3.3%, and 4.5%, showing that the loss curve is somewhat concave (bowed downward). This behavior is

visually apparent for all the individual portfolios except Keystone, which again may be affected by vintaging (i.e., a

loan’s issue year) effects of the financial crisis – meaning that loans with a good deal of seasoning (which are the

ones that date to before the crisis) have higher loss rates than if the financial crisis had not occurred. Since a large

share of the more seasoned loans in the pooled portfolios are Keystone loans (consistent with Figure 9), this may

also affect the latter years in the overall curve.

Figures 10 and 11 show the relationship between loan performance and credit score across the pooled portfolios.

Figure 10 shows how delinquency rates decline as credit score increases; Figure 11 demonstrates how cumulative

gross loss rates increase as credit score declines. Loans to customers in the highest credit score bin have one-third

of the delinquencies of the combined portfolios as a whole. Figure 11 shows a similar relationship between

cumulative gross losses and credit score: the higher the credit score, the lower the losses. Differences are apparent

in the first year of seasoning and grow as the loans mature. After three years of seasoning, loans issued to

customers with the lowest credit scores (300-600) have cumulative gross loss rates more than 21 percentage

points higher than customers with the highest credit scores (781-850). For loans issued to customers in the two

highest credit score bins, cumulative gross losses are less than 5% after eight years.

0%

1%

2%

3%

4%

5%

6%

7%

8%

0 1 2 3 4 5 6 7 8

Cumulative Gross Loss Rate

Years Seasoned

Smart-E Keystone Michigan Saves NYSERDA Overall

March 2022 www.seeaction.energy.gov 15

F

igure 10. Delinquency (share of outstanding loans) by credit score bin

F

igure 11. Cumulative gross loss by credit score bin

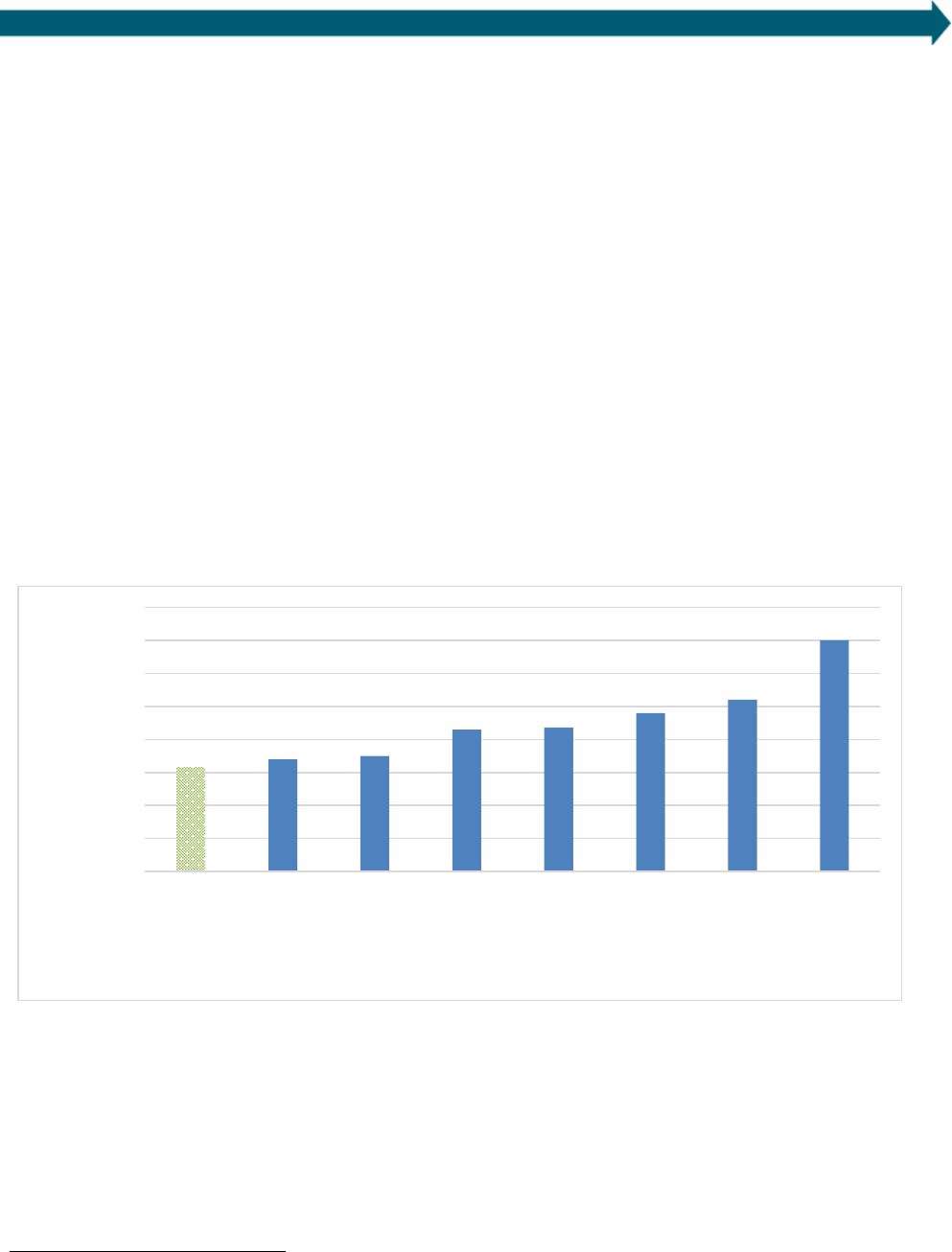

Loan performance does not show the same degree of sensitivity to census tract income, as shown by AMI bands in

Figures 12 and 13. Delinquency and loss rates decline as income increases, but not to as great an extent as they do

with credit score increases. For example, delinquency rates in the lowest credit score bin (300-600, Figure 10) are

about 12 times higher than the delinquency rates in the highest credit score bin (781-850), but delinquency rates

in the lowest AMI band (0-60%, Figure 12) are only 1.9 times as high as in the highest AMI band (>120%). As shown

0%

1%

2%

3%

4%

5%

6%

7%

n=388 n=2698 n=9365 n=11839 n=8047 n=33239

300-600 601-660 661-720 721-780 781-850 Overall

FICO Bin

Share of Outstanding Balance

(Delinquency)

Delinquency Rate

0%

5%

10%

15%

20%

25%

0 1 2 3 4 5 6 7 8

Cumulative Gross Loss Rate

Years Seasoned

300-600 601-660 661-720 721-780 781-850 Overall

March 2022 www.seeaction.energy.gov 16

in Figure 13, cumulative gross loss rates are highest in the lowest AMI band (0-60%) but are only higher than the

loss rate in the highest AMI band by five percentage points after five years.

10

Figure 12. Delinquency (share of outstanding loans) by program and AMI band

10

The cumulative gross losses by income band do not include loans from Keystone due to the lack of census tract data in that dataset. Since

Keystone has some of the oldest loans in the dataset, its absence in this figure contributes to the loss rates not extending to year eight as they

do for most credit score bins in Figure 11.

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

n=3355 n=5908 n=7847 n=4199 n=3499 n=33239

0-60% 60%-80% 80%-100% 100%-120% >120% Overall

Share of Oustanding Loans

(Delinquency Rate)

AMI Band

Delinquency Rate (Dollars)

March 2022 www.seeaction.energy.gov 17

Figure 13. Cumulative gross loss rates by AMI band

The relationship between income and credit, and implications for programmatic lending

It is commonly believed that high-income households also have high credit scores. In fact, there is generally a small

positive correlation between income and credit score, but this correlation is lower than might be expected. In the pooled

data, the correlation

11

between the median household income of the census tract where borrowers live and their credit

scores is only 0.11 – meaning that census tract median income explains only about 11% of the variation in credit scores

and vice versa. Moreover, this low correlation does not appear to be due to use of a census tract-based income. In

Michigan, the correlation between census tract median income and credit score is similar at 0.10; the correlation

between household income and credit score is considerably lower, at 0.015.

These findings do not suggest that income per se is not important to understanding loan performance. All the programs

in this analysis generally include a debt-to-income threshold in their loan underwriting. (The partial exception is

NYSERDA, which allows higher than traditional DTI ratios with satisfactory mortgage payment history under its “Tier

2” underwriting option, and in January 1, 2019 eliminated maximum DTI ratios for applicants with FICO scores greater

than 780). Rather, the findings suggest that, for households that pass the debt-to-income screens implemented by the

programs (see Table 2), income matters relatively little – and less than credit – for understanding delinquencies and

losses. These DTI ratios may screen out many low-income households; this analysis does not explore whether

alternative DTI thresholds could be set.

This report finds that credit score predicts delinquencies and charge-offs far better than income. Figures 10 through 13

demonstrate this finding in the raw data, and the regression analysis in Section 3.2.3 confirms that the association

between performance and credit is much stronger than that between performance and income. These findings suggest

that lenders can expect strong payment performance from households in lower-income areas that (1) have strong credit

and (2) meet debt-to-income screens similar to those in these programs. Many households in the data fit this description.

Of participating households in census tracts below 100% AMI, 48% had credit scores above 740 – similar to the share of

participating households in census tracts above 100% AMI with credit scores above 740 (56%).

11

“Correlation” refers to Pearson’s correlation coefficient.

0%

1%

2%

3%

4%

5%

6%

7%

8%

0 1 2 3 4 5 6 7 8

Cumulative Gross Loss Rate

Years Seasoned

0-60% AMI 60%-80% AMI 80%-100% AMI 100%-120% AMI >120% AMI Overall

March 2022 www.seeaction.energy.gov 18

3.2.2. Prepayment

This section briefly discusses prepayment rates in the studied portfolios. Prepayment occurs when a borrower pays

the loan in full prior to the scheduled loan maturity.

12

All values in this section exclude Smart-E loans, since Smart-

E program data did not include the date loans were prepaid.

Most loans in the studied portfolios are still active. Among loans that have come to term (loans whose scheduled

maturity was prior to the end date of each portfolio’s dataset), borrowers reach about 70% of the loan term on

average before paying in full. This average combines loans prepaid at various points in the term with loans carried

to the full term. It should be noted that the average term of these loans is 56 months; most of these loans are

Keystone loans with five-year terms. These loans are not representative of the larger pool of loans since very few

longer-term loans or loans from other programs have come to term.

The cumulative prepayment rate is the share of the original loan balance that has been prepaid after a period of

time. For example, the cumulative prepayment rate for loans that have seasoned for at least three years is the

value of loans that has been fully prepaid through those three years as a share of original balance for those loans.

In the pooled loans, after three years, about 17% of the original loan balance has been fully prepaid. After six

years, that cumulative prepayment rate is about 32%. The data do not provide enough information for us to

include partial prepayments in these calculations, so the figures above are underestimates of the true prepayment

rate in these portfolios.

3.2.3. Regression analysis

This regression analysis builds on the high-level program, credit, and income trends in the previous section by

parsing the impact of the various determinants of loan performance discussed above. The logistic regression

measures the change in the likelihood of delinquency and charge-off depending on borrower and loan

characteristics: principal amount, income bin, credit score, loan seasoning, interest rate, and which program issued

the loan. The regression demonstrates the impact of each factor while holding all the others constant. See

Appendix A for more details on the regressions.

Our analysis splits out two subprograms in NYSERDA, On-Bill Recovery and Smart Energy, to account for

differences in program design and customer characteristics in these programs. Note that the regression models

presented here include income as a variable, and therefore exclude Keystone HELP due to lack of income data.

When removing income and adding Keystone HELP back to the analysis, results for the other variables are similar

to those presented here. For regression tables, see Appendix A.

3.2.3.1 Credit score regression results

Credit score stands out as a consistent, statistically significant predictor of delinquency and charge-off. Higher

credit scores are associated with lower chances of delinquency and charge-off for every portfolio. Considering

Figure 10, this is not a surprise.

The association between credit score and charge-off is larger than the association between credit score and

delinquency (see Table A-1). For charge-offs, a 100 point increase in credit score is associated with a 5.81

percentage point decrease in the chances a loan is charged off.

13

A 100-point increase in credit score is associated

with only a 1.06-percentage point reduction in the chance of delinquency. Still, both relationships have strong

statistical significance.

14

Program-specific regressions show similar impacts; while the magnitude of the

12

Lenders generally prefer for loans to be carried to term. If a loan is prepaid, then the investor will not receive part of the interest payments

that they may have been expecting.

13

The term ‘percentage point’ is used to distinguish a difference in percentages from a “percent of a percent” change; “percentage points”

refers to the former. For example, a change from 1% to 2% is a change of one percentage point.

14

Note that the positive correlation between borrower credit score and loan performance is not unique to energy efficiency loans.

March 2022 www.seeaction.energy.gov 19

relationships varies somewhat, in all cases higher credit scores are associated with lower chances of delinquency

and charge-off, and in all cases the relationships are statistically significant at conventional levels of significance.

3.2.3.2 Income regression results

Across all portfolios combined, relative to loans in the 0-60% AMI band, the chance of charge-off decreases for

loans in the three highest income bands (80-100% AMI, 100-120% AMI, > 120% AMI). These differences are

statistically significant. Holding all else equal, households in the > 120% AMI band have a charge-off rate 1.98

percentage points lower than those in the < 60% AMI band. When examining delinquency, loans in the two highest

income bands (100-120% AMI, > 120% AMI) show statistically significantly lower rates of delinquency than loans in

the lowest income band. Both the high-income bins show a rate lower by 0.50 percentage points relative to the

rate in the <60% AMI band (see Table A-2).

In single-portfolio regressions, the impacts of income on charge-off were often, but not always, statistically

significant. The impact of income on delinquency were almost never statistically significant. This difference

between pooled and single-portfolio results suggests that the scale of the study – in these regressions (which do

not include Keystone HELP), about 25,000 loans – is important to demonstrate a relationship between income and

loan performance, especially in the case of delinquency. When pooling the programs, the relationships emerge;

however, single portfolios do not have adequate sample size to clearly demonstrate them. This stands in contrast

to credit score, where associations with both delinquency and charge-off are clear and large even in single-

portfolio regressions.

One possible explanation for the relatively weak relationship between income and loan performance (also shown

in Figure 12) is that the income variable is based on the median income of the census tract, rather than the income

of the household itself. Census tract income is a blunt signal of actual household-level income. However, the data

do not suggest that use of census tract incomes, rather than household incomes, is consequential for these results.

For Michigan Saves – the one program with available household-level income data – the correlation between

household income and census tract median income is relatively weak (0.20). However, the relationships between

household income and charge-off/delinquency are not clearly different than those using census tract median

incomes. Regression analysis on the Michigan Saves data shows that household incomes – like census tract median

incomes – are associated with charge-offs, with a $10,000 increase in income decreasing the chance of charge-off

by 0.26 percentage points. Household income is not a statistically significant predictor of delinquency in the

Michigan Saves data. Both results are similar to the results of regression analysis on the Michigan Saves program

using census tract incomes.

3.2.3.3 Program regression results

The regression analysis generally confirms the differences in overall program delinquency and loss rates presented

in Section 3.2.1. Connecticut Smart-E has the lowest charge-off rates when controlling for the other factors

discussed in this section, and NYSERDA’s Smart Energy loans have the highest.

15

Smart-E and both NYSERDA

programs have the highest delinquency rates, while Keystone and Michigan Saves have the lowest. It is beyond the

scope of this study to consider program-specific features that might explain these differences in performance.

Overall, while some of these differences are statistically significant, they are relatively small in magnitude.

3.2.3.4 Other regression results

In addition to credit score and income, the regression analysis also estimates the impact of principal amount,

interest rate, and seasoning on loan performance. This section reviews only the results for regressions on the

combined portfolios.

15

This study observes higher chances of delinquency in NYSERDA’s on-bill loans relative to its Smart Energy loans, consistent with the findings

in Deason (2015) several years earlier in the program’s lifespan. However, Deason (2015) did not study charge-offs. The results in this report

show that NYSERDA’s on-bill loans are not charged off more often than its Smart Energy loans; in fact, controlling for other factors, they are

charged off less often, though the difference is not statistically significant.

March 2022 www.seeaction.energy.gov 20

Principal amounts have a statistically significant association with charge-offs, but not with delinquencies. Even for

charge-off, the effect is relatively small: a $10,000 increase in principal amount only increases the chance of

charge-off by 0.46 percentage points.

A 1-percentage point increase in interest rate increases the chance of charge-off by 2.29 percentage points for all

programs combined. Interest rate does not have a statistically significant impact on delinquency.

Loan seasoning does have clear associations with loan performance. A loan’s chance of charge-off increases by

0.76 percentage points for each year it has seasoned, while the chance of delinquency decreases by 0.11

percentage points for each year of seasoning. Seasoning can only increase the chances a loan becomes charged

off, since charge-off can occur only once. On the other hand, loans can and do go in and out of delinquency. The

fact that the relationship is reversed for delinquency suggests that borrowers who have trouble repaying their

loans tend to get in trouble relatively quickly – which is consistent with the shape of the loss curves in Figures 9,

11, and 13.

4. Comparators

A key purpose of this research is to help assess whether energy efficiency loans perform differently than other

comparable financial products. Observers have long theorized that energy efficiency loans may carry a

performance premium. If so, there may be a number of potential reasons:

• These loans generate their own cash flow (through energy cost savings) to help service the debt.

• Participating borrowers have particular characteristics that make them likely to repay, whether easily

observable (e.g., credit scores) or not (e.g., adoption of energy efficiency measures may be a sign that a

borrower tends to be frugal or pay close attention to costs, so these products might select for borrowers

with an otherwise unobservable tendency to repay reliably).

• Participants see clean energy improvements as an investment in their home and treat that investment

similar to the way they would a loan that is secured by the home.

• Borrowers may seek these loans out because they believe they are doing something beneficial for the

environment and would see failing to make payments as undermining their good deed.

• Program structures and safeguards (e.g., careful contractor vetting and approval as well as well-executed

project approval and underwriting processes) help forestall predatory lending and otherwise avoid

abusive lending practices that may be present to a greater extent in other loan pools.

To contextualize these results, this section compares the delinquency and charge-off performance of the energy

efficiency loans in this study with several indices of loan performance. These comparisons cannot specifically

determine whether efficiency loans carry a performance premium relative to otherwise similar non-efficiency

loans, but they do help situate their performance relative to better-known asset classes.

4.1. Methodology

The analysis first identifies several relevant comparator financial products. There is no one perfect comparator to

residential energy efficiency loans. In a sense, energy efficiency loans are a specialized type of home improvement

loan; however, most home improvement loans are for more expensive renovation projects and may be secured by

the home. Instead, Berkeley Lab chose general consumer loans and auto loans as comparators.

16

Consumer loans

are broadly similar to energy efficiency loans in that they are generally unsecured loans made to individuals,

although consumer loans are made without regard to dwelling ownership (or rental) status. While different types

of consumer loans (and consumer loans to different customers) vary substantially, in general these loans have

similar principal amounts on shorter terms (and therefore higher monthly payments), and carry considerably

16

While mortgages are another potential comparator, the fact that mortgages are secured by the home, and the much longer loan terms of

many mortgages, make them less suitable for comparison.

March 2022 www.seeaction.energy.gov 21

higher interest rates than the studied energy efficiency loans.

17

Auto loans differ in that they are secured by the

vehicle, meaning that one might expect somewhat stronger repayment performance. Average auto loan amounts

and monthly payments are higher than residential energy efficiency loans and average terms are shorter, while

interest rates are similar for new cars and higher for used cars. Average credit scores for new car loan borrowers

are similar to the energy efficiency loan borrowers, while average credit scores for used car borrowers are

considerably lower.

18

Most importantly, both consumer loans and auto loans have very large markets and are well-

characterized by public loan indices.

Comparator loan performance data comes from three sources:

• Data maintained by the Federal Reserve (“Fed”). The Fed data

19

cover loans reported by brick-and-mortar

banks, including credit card loans as well as non-credit card personal loans.

• Loan performance indices maintained by Kroll Bond Rating Agency (KBRA). The KBRA Marketplace

Consumer Loan indices cover securities comprised of loans made by online lenders (often known as

FinTech loans), separated into three tiers by the average credit quality served by each lender. The analysis

uses data for Tier 1 loans in the KBRA index, which include deals with average credit scores from 710 to

740 (and are therefore the appropriate comparator for energy efficiency loans). KBRA also reports two

auto loan indices, one for prime auto loans and one for non-prime auto loans. While there is no universal

division between the two, non-prime loans are generally loans to borrowers with credit scores in the mid-

600s and below. The analysis therefore focuses on the prime auto loan index.

• Loan data sampled from credit reports by TransUnion. While TransUnion data cover auto loans, bankcard

loans, and unsecured personal loans, the analysis only includes their data on unsecured personal loans

here. TransUnion usefully subdivides these loans further by type of lender (e.g., banks vs. credit unions),

providing greater resolution on personal loans than the other indices.

The comparisons focus on the same two performance metrics used elsewhere in this report: 30-day delinquencies

and cumulative gross losses. All indices define 30-day delinquencies in the same way that this report has defined

them.

In terms of losses, earlier sections of this report show loss curves over time. For most comparators the data to

support these curves are not available, though KBRA helpfully supplied us with the requisite data for two of their

loan indices. Most comparators instead report an annualized loss rate, which indicates the share of the portfolio

that would be expected to be lost in a year. Annualized losses are readily calculated for large portfolios that can be

assumed to be at “steady state,” meaning that loans of many different maturities are present and the overall

seasoning of the portfolio is not changing significantly over time. In the energy efficiency loan data, this is not the

case: the majority of loans are still relatively unseasoned. In this situation a common ratings agency practice is to

“gross up” cumulative losses to the loss rate expected at loan maturity. However, few loans in the portfolios

studied here have reached maturity (nearly none in some portfolios). Instead of attempting to forecast losses at

maturity, the annualization method employed here divides losses at the time they are observed by the average

seasoning of the loans. This method essentially assumes losses occur at a constant rate over time, which is not

consistent with Figure 9; however, there is no ready alternative. Since loss rates do decline somewhat with

seasoning, this method likely overestimates the loss rates in a mature portfolio of these efficiency loans.

Even setting aside this difference in annualization method, this annualized loss calculation differs from the

comparators in two other respects:

17

See the following sources regarding unsecured consumer loans: https://www.lendingtree.com/personal/personal-loans-statistics/;

https://www.fool.com/the-ascent/research/personal-loan-statistics/;

https://fred.stlouisfed.org/series/TERMCBPER24NS; https://www.chamberofcommerce.org/personal-loan-statistics.

18

See https://www.experian.com/content/dam/noindex/na/us/automotive/finance-trends/state-of-auto-finance-q2-2021.pdf for data on auto

loans and auto loan borrowers.

19

See https://www.federalreserve.gov/releases/chargeoff/

March 2022 www.seeaction.energy.gov 22

• Gross rather than net charge-offs. KBRA reports net charge-off rates that include revenues from

recoveries.

20