Homeless System Response:

Long-Term Financing of Permanent Supportive Housing

Projects

The recent influx of Emergency Solutions Grants (ESG) program funding in jurisdictions across the country as a result

of the Coronavirus Aid, Relief, and Economic Security (CARES) Act provides communities with funds to prevent people

at risk of homelessness from experiencing homelessness and to rehouse those experiencing homelessness. However,

to serve individuals and families with higher-acuity needs, many communities are looking to invest in permanent

supportive housing (PSH) to accommodate this population long-term. This document serves as a primer on PSH and

details both established and innovative strategies and sources for financing PSH.

Permanent Supportive Housing Models

PSH combines affordable housing with voluntary supportive services that help those exiting homelessness and other

institutions obtain and maintain housing as well as improve health and connect with the community. Supportive

housing is targeted to individuals and families with high-acuity needs, including people who have experienced chronic

homelessness, have co-occurring disorders, or have a history of incarceration; transitional age youth; and families

engaged with child welfare. Like rapid rehousing (RRH), PSH should provide services to help households maintain

housing; they may be more intensive than those provided in RRH projects, but PSH is not time-limited.

Supportive housing falls into three main models: single-site, scattered-site, and integrated housing. In single-site

supportive housing, buildings have a majority of units dedicated to supportive housing tenants. Services are delivered

in the supportive housing building, often with offices on the ground floor. In scattered-site supportive housing, units

are usually rented from private market-rate landlords that are paid with money from a source of rental support

funding, such as housing vouchers. Supportive services help the tenant stay housed and can be provided in the

household’s unit or off-site in the community. A third supportive housing model is the mixed-income/mixed-tenancy

model that joins both supportive and affordable housing units in a single property. Services are often delivered in the

integrated housing building, as well as sometimes off-site at the service provider’s offices.

Centering Those With Lived Expertise in Leadership and the Planning Process

Lived expertise is an invaluable resource when planning a supportive housing program. In order to be successful,

programs benefit from incorporating the full participation of individuals whom the project will serve to inform design,

amenities, community connections, service needs, and delivery. Strategies for incorporating tenant voice include but

are not limited to: having people with lived expertise as part of the project planning team, holding focus groups with

people from the population you are trying to serve, implementing regular tenant surveys into your project plan, hiring

people with lived expertise, and including people with lived expertise on your board. These strategies are crucial to

the planning process because they help amplify the voices of those most impacted by housing instability and

homelessness.

Leading with Building Racial Equity into Your Supportive Housing Program

Black, and Indigenous, and People of Color (BIPOC) are overrepresented in the populations of the systems that

supportive housing serves, such as the homeless, justice, and child welfare systems. Supportive housing programs

must rigorously incorporate a racial equity approach from the beginning of the planning process to address long-

standing barriers to equitable access to housing and services. This includes having racially diverse partners in the

planning process to include decision-making on funding, partnering with culturally specific organizations, building

racial equity into the hiring process, creating policies leading with a racial equity lens, and tracking program outcomes

by race and ethnicity.

Supportive Housing Financing

Depending upon the type of supportive housing being operated, supportive housing financing will require three types

of budgets and funding resources: capital, operating, and services funding. Funding is usually provided through a

combination of federal, state, and local funding. Financing breaks down by model in the following ways:

● Single-site requires capital, operating, and services funding.

● Integrated requires capital, operating, and services funding

● Scattered-site typically only requires operating and services funding, as it leverages existing housing stock

and units.

Sources of Funding for Supportive Housing

Government. Federal, state, and local government agencies allocate funding and establish eligibility for affordable

and supportive housing from entitlement and block grants as well as competitive bids or responses to an application

or request for proposal (RFP). The type of expenditure (capital, operating, service) will dictate the appropriate agency

source and whether the funding takes the form of a grant, a loan, or a forgivable loan.

Private Corporations and Financial Institutions. Private corporations—including financial institutions and health

systems—may provide grants or loans for capital investment. Repayment terms vary by PSH project and funding

source. Hospitals in particular have provided capital investment as well as services funding for supportive housing.

Philanthropy. Philanthropy from foundations, community associations, and private corporations provides a wide

range of grants for services, capital, and operating expenses. Philanthropy can also provide valuable “seed” funding to

launch a new development or program idea.

Sources of Capital, Operations, and Services Funding

Each of the three categories of PSH funding is supported through various resources. The following section breaks

down funding sources in each of the different PSH funding categories.

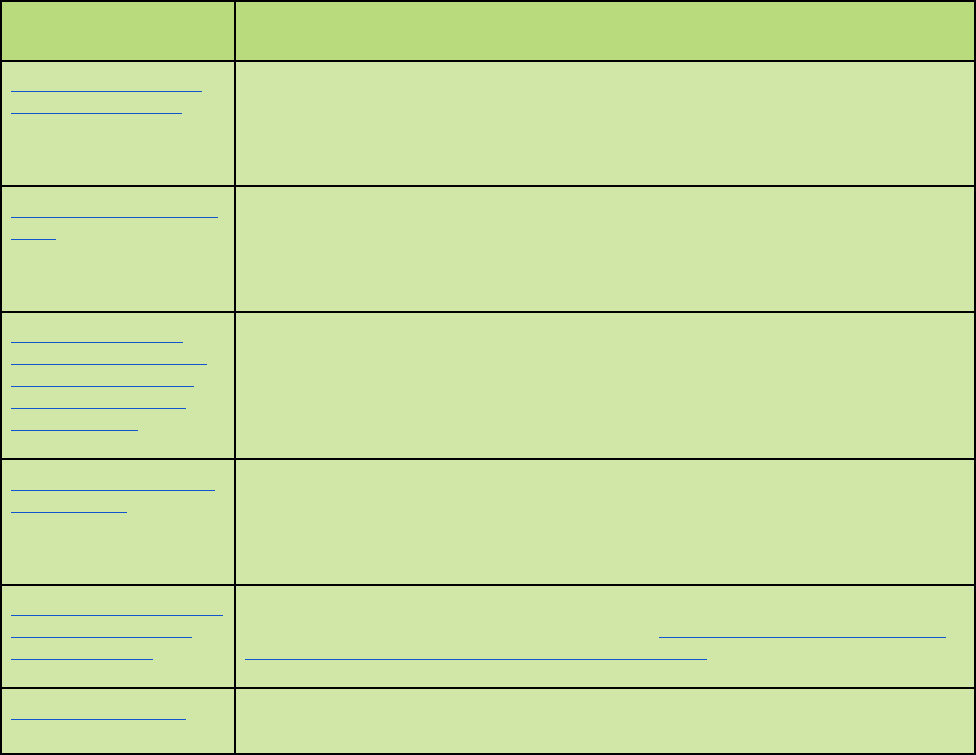

Capital Funds

Capital funds are required to acquire, build, or rehabilitate units that will be dedicated to supportive housing. In

addition to “bricks and mortar,” capital costs can cover building and land acquisition, architectural fees, financing fees,

and project management costs. It is most common in the single-site and integrated supportive housing models,

although there are also examples of scattered-site programs that utilize capital funds to acquire and rehabilitate new

housing units. Below are sources of funding traditionally used by communities to cover capital costs.

Funding Source

Things to Know

Low-Income Housing

Tax Credit (LIHTC)

The LIHTC is a federal tax credit allocated to states to incentivize investment

in affordable housing from private investors. LIHTC properties often have units

set aside for supportive housing and extremely low-income households. The

LIHTC is the largest program for creating new affordable housing units.

National Housing Trust

Fund

The National Housing Trust Fund provides funds for the creation, preservation,

and operation of affordable housing for low- and extremely low-income

households. While the National Housing Trust Fund is a federal program, funds

are allocated to the states to support local affordable housing priorities.

Home Investments

Partnerships Program

(HOME)/Community

Development Block

Grant (CDBG)

Many states and local communities allocate a portion of their federal

entitlement grants to provide flexible loans or grants for the capital costs to

develop affordable and supportive housing. Supplemental allocations of CDBG

funding under the CARES Act can be invested to create PSH units.

Pay for Success/Social

Impact Bond

With pay for success or social impact bonds, private funders invest in a project

that is then rigorously evaluated to assess targeted outcomes. If the project is

a success, the government pays back the investor. There are several examples

of this program being used to create more supportive housing.

Section 811 Supportive

Housing for Persons

with Disabilities

Through this program, HUD provides capital funds and rental assistance to

create and operate supportive housing units. In recent years the Section 811

program is primarily allocated for rental assistance.

Federal Home Loan

The Affordable Housing Program (AHP) Competitive Application Program

through the Federal Home Loan Bank allows organizations to apply for

Funding Source

Things to Know

Bank

financing for the construction, rehabilitation, or purchase of low-income rental

housing, including supportive housing. Awards from the Federal Home Loan

Bank are made in partnership with local financial institutions.

Hospital and Health

System Investment

Ongoing program studies document that housing is healthcare. Based on

research demonstrating that providing housing improves health outcomes,

some hospitals and other health system partners (including managed care)

have begun investing in supportive housing providing both capital and service

funding. The New Jersey Housing and Mortgage Finance Agency is partnering

with local hospitals to invest in supportive housing capital development. In

Orlando, Florida, the hospital system partnered with the local government,

health center, and housing providers to place the most vulnerable in stable

housing with services.

New Market Tax Credit

(NMTC)

The New Market Tax Credit incentivizes investment for capital development in

low-income communities. NMTC is a competitive federal tax credit program

with priority awards to projects that can demonstrate a positive impact on the

communities being invested in. NMTC investments can be used to provide

capital for new mixed-use developments that include supportive housing.

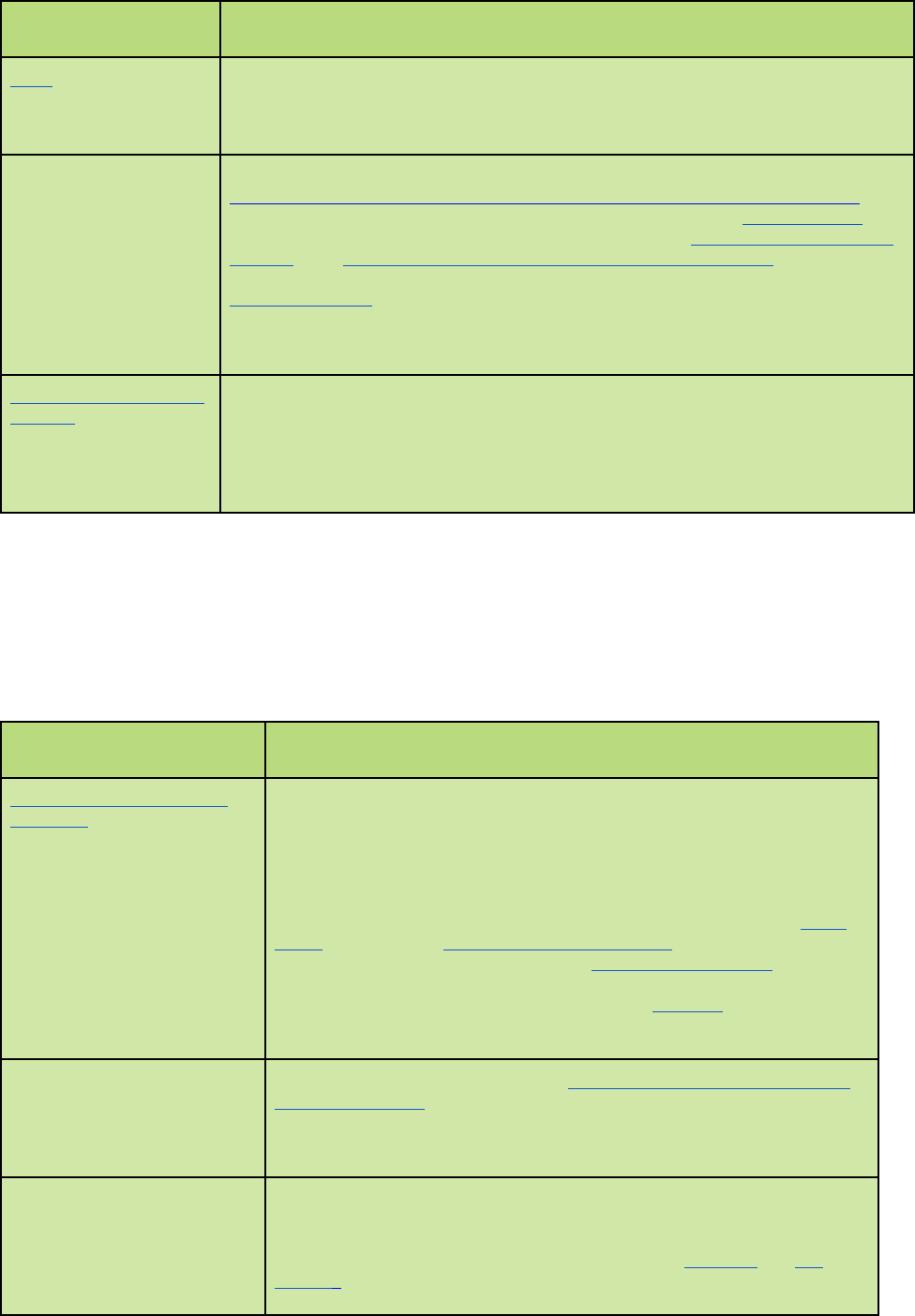

Operating Funds

Rental income is the primary source of funding to cover operating costs incurred such as property management,

staffing, utilities, maintenance, insurance, and taxes. In supportive housing, tenant income is generally insufficient to

pay rents to cover operating expenses without rent subsidies to fully cover these costs. In addition to rental

assistance, some properties are able to establish reserves to cover operating deficits at the property. Many sources of

operating subsidies require tenants to pay some portion of what income they do have toward their rent, usually set at

30 percent.

Funding Source

Things to Know

Federal Rental Assistance

Vouchers

Rental assistance vouchers, funded through HUD and managed by

CoCs, provide the majority of operations funding for supportive

housing developments. Housing vouchers, generally administered by

local housing authorities, provide rental subsidies to property owners

for units occupied by income-eligible tenants. There are general

Housing Choice Vouchers, and also voucher programs that apply to

specific populations targeted in supportive housing, including HUD-

VASH for veterans, Family Unification Program (FUP) for families

involved in the child welfare system, Mainstream vouchers for

vulnerable populations including people experiencing chronic

homelessness and disabling conditions, and HOPWA for individuals

with HIV/AIDS.

State Housing Vouchers

Some states, including New York (Empire State Supportive Housing

Initiative [ESSHI]) and California have state-funded vouchers for

supportive housing units. These are often funded by local state

appropriations or bonds.

Flexible Housing Pools

(FHPs)

FHPs are funded by contributions from private funders as well as

state and local governments. The pools provide flexible funding to be

used for rental subsidies, landlord mitigation risk funding, and some

services. Examples of FHP can be found in both Chicago and Los

Angeles.

Funding Source

Things to Know

Capitalized Operating

Reserves

A capitalized operating reserve is an upfront investment into a

development during the construction’s financial closing, which is held

in a reserve account for later use to pay for operating shortfalls.

Capitalized operating reserves are generally deployed when other

rent subsidies are not available. Both the State of California and the

City of Chicago operate capitalized operating reserve programs for

PSH.

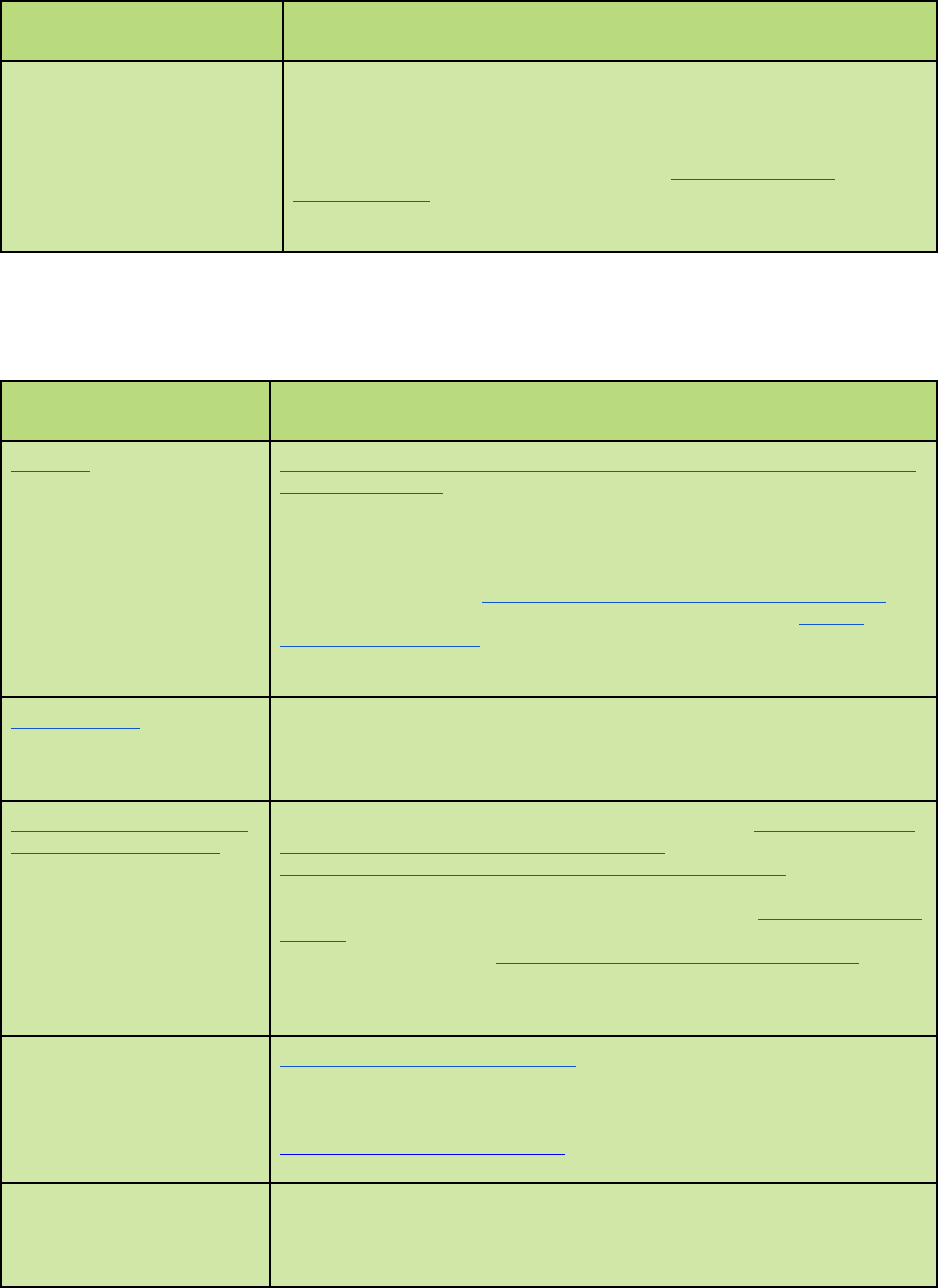

Services Funding

Service costs include both direct services like mental health counseling and case management, as well as costs

associated with tenancy supports and life and jobs skills training.

Funding Source

Things to Know

Medicaid

Medicaid can be a sustainable source of service funding for supportive

housing programs. Funding for Medicaid is shared through both federal

and state resources and is mostly dedicated to primary, behavioral,

and mental health services. While Medicaid will cover services for more

tenants in states that chose to expand Medicaid, non-expansion states

can also consider billing supportive housing services to Medicaid. Some

states have created a Medicaid supportive housing services benefit

through State Plan Amendments and Waivers. There are several

administrative models for supportive housing agencies to consider to

bill Medicaid for services.

CoC Programs

CoCs provide funding for some services in PSH for individuals moving

out of homelessness, though most PSH programs are leveraged with

other service’s resources.

Department of Health and

Human Services (HHS)

Many sub-departments within the HHS including the Substance Abuse

and Mental Health Services Administration (SAMHSA) fund the

Cooperative Agreement to Benefit Homeless Individuals (CABHI)

providing funding for mental health and substance use; Health

Resources and Service Administration (HRSA) funds community health

centers to serve vulnerable populations including those facing

homelessness; and the Administration for Children and Families (ACF)

administers grants for supportive housing services. These grants are

administered at the state, local, and project levels.

Department of Justice

(DoJ)

The Bureau of Justice Assistance, which is part of the DoJ, has issued

several Notices of Funding Availability (NOFA) related to the Second

Chance Act that have included opportunities for funding supportive

housing for individuals exiting the criminal justice system. View an

example of one of these NOFAs.

State and Local Services

Programs

Many states and large cities have programs that provide funding for

supportive housing services. These are funded through special tax

initiatives, ballot measures, and other ways.

Special Considerations for Supportive Housing Financing

Braided Funding

Successfully funding services in supportive housing can be a challenge as there is not a single “go-to” source for

services funding. Most supportive housing programs rely on services funding from multiple sources to create

sustainable supportive housing programs. This is frequently referred to as “braided” or “blended” funding. It is

important when working in a braided funding model to track the operating procedures and other requirements that

the various funders set.

Coordination

Supportive housing requires multiple partners—including developers, service providers, and property managers—to

work together to create and operate programs. This makes coordination between funders essential to a supportive

housing project’s success. Supportive housing partners benefit from working together as early in the process as

possible; defining shared goals; and creating action plans, coordination procedures, and accountability through data

collection all documented in a Memorandum of Understanding.

Engaging Stakeholders

When building supportive housing in a community, it is important to combat potential community opposition by

engaging community stakeholders during the development process. The Not In My Backyard (NIMBY) sentiment is a

common reaction to supportive and affordable housing. Successful supportive and affordable housing projects

communicate with the surrounding neighborhood through both informal conversations and open forums. The team

developing the supportive housing project must be prepared to combat common misperceptions about supportive and

affordable housing, including that it can bring down property values and increase crime. People with lived expertise

can also be important and effective advocates for building supportive housing in a community.

This resource is prepared by technical assistance providers and intended only to provide guidance. The contents of this document, except when

based on statutory or regulatory authority or law, do not have the force and effect of law and are not meant to bind the public in any way. This

document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies.