Office of Chief Counsel

Internal Revenue Service

memorandum

Number: 201023053

Release Date: 6/11/2010

CC:PA:01:RJGoldstein

POSTN-105123-10

UILC: 6501.07-00, 6501.07-10

date: April 29, 2010

to: Kathy Sexton

Technical Services Group Manager

(Small Business/Self-Employed)

from: Blaise Dusenberry

Senior Technician Reviewer

(Procedure & Administration)

subject: IRC Section 6501(e) Question

This memorandum responds to your request for advice.

ISSUE

Are amounts received or accrued reduced by returns and allowances when determining

gross income for purposes of I.R.C. section 6501(e)(1)(A)(i)?

CONCLUSIONS

When determining gross income for purposes of I.R.C. section 6501(e)(1)(A)(i), the total

amounts received or accrued from the sale of goods or services should not be reduced

by returns and allowances.

FACTS

You have requested assistance on the manner in which a taxpayer accounts for returns

and allowances in determining gross income for purposes of I.R.C. section

6501(e)(1)(A)(i). Section 6501(e)(1)(A) provides that if a taxpayer omits from gross

income an amount properly includible therein which is in excess of 25 percent of the

amount of gross income stated in the tax return, the tax may be assessed, or a

proceeding in court for the collection of such tax may begin without assessment, at any

time within 6 years after the return was filed.

POSTN-105123-10

2

Section 6501(e)(1)(A)(i) specifically addresses cases involving a trade or business and

includes a special rule for determining gross income. Under this subsection, gross

income is defined as the total of the amounts received or accrued from the sale of

goods or services (if such amounts are required to be shown on the return) prior to

diminution by the cost of such sales or services. Returns and allowances (and other

income) are not specifically mentioned. You have asked if in a case involving a trade or

business, a taxpayer’s gross receipts and sales should be reduced by returns and

allowances when calculating gross income.

In some cases, the 25 percent omission computation hinges on how to treat returns and

allowances. For example, Exam may make adjustments in both gross receipts and

returns and allowances. If gross income is determined by reference to gross receipts

without subtracting returns and allowances, the omission does not exceed 25 percent.

However, if returns and allowances are subtracted from gross receipts to determine

gross income, without reduction for costs of sales, then the omission exceeds 25

percent and the six-year statute under § 6501(e) applies. The following chart illustrates

this scenario:

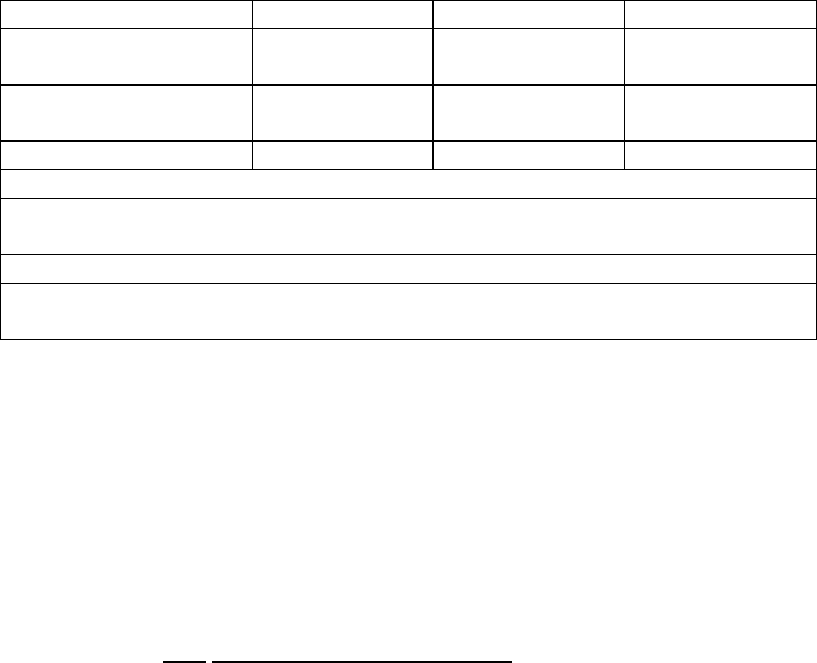

Per Return Per Exam Adjustment

Sch C Gross

Receipts

500,000.00 600,000.00 100,000.00

Returns &

Allowances

(50,000.00) (5,000.00) 45,000.00

"Net Gross Receipts" 450,000.00 595,000.00 145,000.00

25% of Gross Receipts at 500,000.00 is 125,000.00. The adjustment

amount is 100,000.00. IRC 6501(e) would not apply.

25% of "Net Gross Receipts" at 450,000.00 is 112,500.00. The

adjustment amount is 145,000.00. IRC 6501(e) would apply.

LAW AND ANALYSIS

In general, taxpayers who sell goods or provide services compute gross income through

a basic computation. This computation results in gross income by subtracting returns

and allowances and cost of goods or services and adding other income to gross

receipts and sales. This computation is illustrated in IRS Form 1120, U.S. Corporation

Income Tax Return, Form 1120S, U.S. Income Tax Return for an S Corporation, and

Form 1040 Schedule C, Profit or Loss From Business. Tax Court decisions likewise

acknowledge that gross receipts are reduced by returns and allowances in computing

gross income. See Friedmann v. Commissioner, T.C. Memo. 2001-207 (Returns and

allowances are taken into account in computing gross income and differ from

expenditures that are business deductions.). Under the Internal Revenue Code and its

POSTN-105123-10

3

corresponding regulations, returns and allowances are sometimes but not always

subtracted to determine “gross income” pursuant to special rules and definitions.

Section 61(a)(2) provides, in part, that gross income means all income from whatever

source derived, including gross income derived from business. Section 1.61-3 of the

Income Tax Regulations provides that in a manufacturing, merchandising, or mining

business, “gross income” means the total sales, less the cost of goods sold, plus any

income from investments and from incidental or outside operations or sources. Thus,

while cost of goods sold is subtracted from total sales to determine gross income,

returns and allowances are not specifically mentioned in section 1.61-3.

A number of other Code provisions and regulations address the issue of whether a

taxpayer reduces its gross income by the amount of returns or allowances for purposes

of those sections. For example, section 41(c)(7), pertaining to the credit for increasing

research activities, provides that gross receipts for any taxable year shall be reduced by

returns and allowances made during the taxable year. Similar provisions that require a

subtraction of returns and allowances from gross receipts include sections 44(d)(5) and

448(c)(3)(C). Section 1.263A-3(b)(2)(ii) provides that gross receipts does not include

amounts representing returns or allowances. Likewise, section 1.448-1T(f)(2)(iv)

provides that gross receipts include total sales (net of returns and allowances) and all

amounts received for services.

There are also a number of regulatory provisions providing that gross receipts are not

reduced by returns and allowances. For example, section 1.1244(c)-1(e) of the

regulations provides that gross receipts are not reduced by returns and allowances for

purposes of section 1244(c)(1)(C) (Losses on Small Business Stock) in determining

whether a corporation’s stock is “section 1244 stock”. The same is true for section

1.1362-2(c)(4), which provides that gross receipts, for purposes of determining

Subchapter S election status, are not to be reduced by returns and allowances, cost of

goods sold or deductions.

The Tax Court has held that returns and allowances are subtracted from gross receipts

to determine gross income. In Pittsburgh Milk Co. v. Commissioner, 26 T.C. 707

(1956), the taxpayer recorded sales of milk on its books at the authorized list prices set

by the state but paid allowances, reductions and rebates back to some of its customers

and entered them on its books as advertising to disguise the true nature of these

payments. These allowances were made pursuant to informal agreements with its

customers. The taxpayer contended that the allowances should be applied to reduce its

gross receipts and sales on the theory that the milk was actually sold for the agreed net

prices. The court looked to the agreement of the parties at the time of sale to determine

the net sales price and held that any amount given back to the customer is considered

an allowance not includible in gross income. Id.

The general definition of gross income and the statutes, regulations, and caselaw on the

subject, however, do not apply for purposes of section 6501(e)(1)(A)(i). This section

POSTN-105123-10

4

creates its own special definition for gross income by defining it as the total of the

amounts received or accrued from the sale of goods or services, if such amounts are

required to be shown on the return, prior to subtracting the cost of sales or services.

This definition is synonymous with gross receipts and sales as the amount includes both

money received and money due from sales during the taxable year (accounts

receivable). There is no case law on point that definitively indicates whether this

amount should be reduced by returns and allowances to calculate gross income for

purposes of section 6501(e)(1)(A)(i).

Our determination that amounts received or accrued should not be reduced by returns

and allowances is based on a plain reading of the statute. The specific language states

“the total of the amounts received or accrued from the sale of goods or services (if such

amounts are required to be shown on the return) …” We believe that under a plain

reading of the statute, the referenced amount is the amount reported on the business

return as gross receipts and sales. See Bencivenga v. Commissioner, T.C. Memo.

1989-239 (For section 6501(e)(1)(A)(i), “[i]n the case of a trade or business … gross

income is the same as gross receipts undiminished by the cost of sales or services.”).

We have included below three examples to help clarify how returns and allowances are

accounted for when computing gross income generally and for purposes of section

6501(e)(1)(A)(i). These examples illustrate: (1) a discount reducing gross receipts and

sales, (2) an allowance reducing gross income but not reducing gross receipts and

sales, and (3) a return reducing gross income but not reducing gross receipts and sales.

1. Business A sells 100 units with a “ticket” price of $100 for $80 each. The

amount received or accrued from the sales of the units that is required to be

shown on Business A’s return is $8,000. The $20 discount is not an allowance

because the amount paid was $80 not $100. $8,000 is reported on the line for

gross receipts and sales but the $2,000 is not reported on the line for returns and

allowances.

2. Same facts as in example 1 except Business A sells all 100 units to Business

B for $100 each. At the time of the sale, Business A agrees to give Business B a

$2,000 rebate for buying all 100 units. Business B pays $10,000 and then

receives a check for the $2,000 rebate. The $2,000 rebate is an allowance on

Business A’s tax return that reduces gross income but it does not reduce gross

receipts and sales. $10,000 is reported on the line for gross receipts and sales

and $2,000 is reported for returns and allowances.

3. Same facts as in example 1 except Business A sells all 100 units to various

customers for $100 each. Twenty customers subsequently return their units.

Business A must report $10,000 as gross receipts and sales (regardless of

whether payment was received). The $2,000 of returned merchandise is

reported as returns and allowances thereby reducing gross income.

POSTN-105123-10

5

The gross receipts and sales reported on Business A’s return is the equivalent of the

total amounts received or accrued from the sale of goods or services for purposes of

section 6501(e)(1)(A)(i). The returns and allowances will reduce Business A’s gross

income on its tax return under the general rule for computing gross income. However,

pursuant to the special definition of gross income under section 6501(e)(1)(A)(i), only

amounts received or accrued are considered and returns and allowances must be

disregarded (as well as cost of goods or services and other income). Accordingly, gross

income for purposes of section 6501(e)(1)(A)(i) is gross receipts and sales.

Please contact Ron Goldstein at (202) 622-4910 if you have any further questions.