FY 2023 GENERAL GRANT AND COOPERATIVE AGREEMENT

TERMS AND CONDITIONS

By accepting funds under this award from AmeriCorps (AmeriCorps is the operating

name for the Corporation for National Service), the recipient agrees to comply with,

and include in all awards and subawards, these General Terms and Conditions, the

program-specific terms and conditions, all applicable Federal statutes, regulations and

guidelines, and any amendments thereto. The recipient agrees to operate the funded

program in accordance with the approved application and budget, supporting

documents, and other representations made in support of the approved application.

The term recipient is used to connote either recipient or subrecipient, as appropriate,

throughout these General Terms and Conditions.

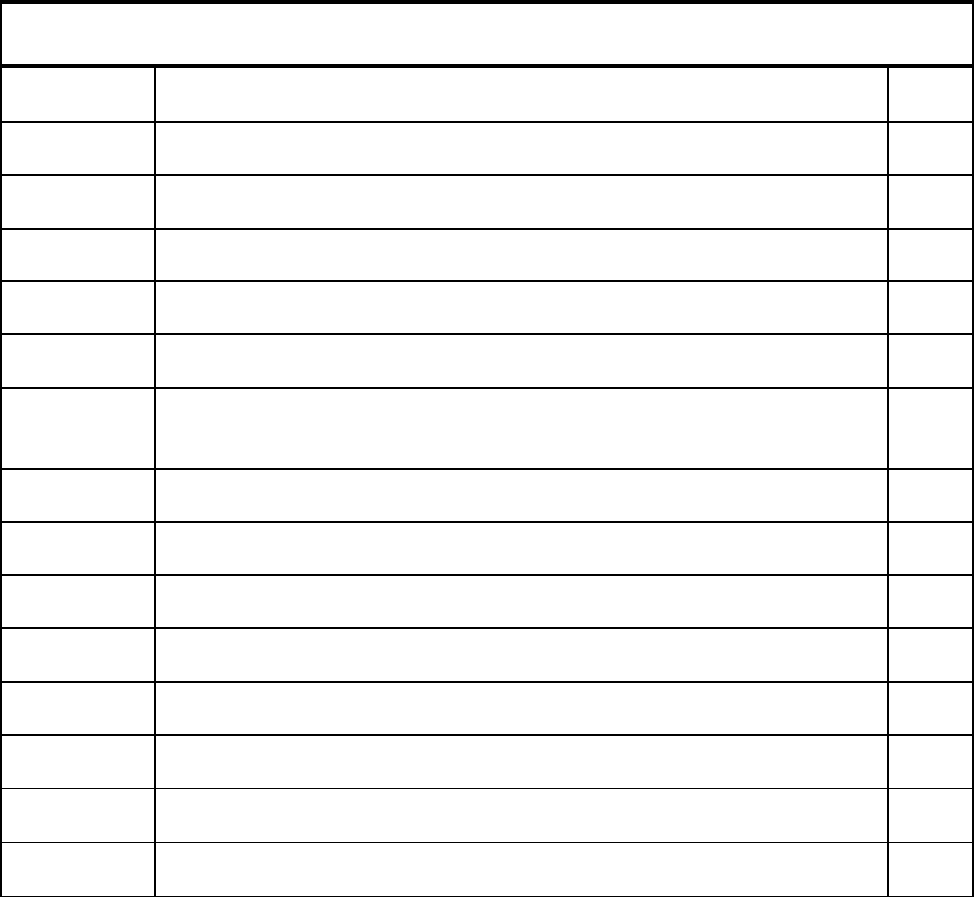

TABLE OF CONTENTS

I.

Changes from the 2022 General Terms and Conditions

2

II. Governing Authorities 3

II.A.

Legislative and Regulatory Authority

3

II.B. Other Applicable Terms and Conditions 3

II.C.

Order of Precedence

4

III. General Terms and Conditions 4

III.A.

Responsibilities Under Award Administration Legislative and

Regulatory Authority

4

III.B.

Financial Management Standards

5

III.C. Changes in Budget or Key Personnel 6

III.D.

Bankruptcy

6

III.E. Prohibited Program Activities 6

III.F.

National Service Criminal History Check Requirements

7

III.G.

The Office of Inspector General

7

III.H. Recognition of AmeriCorps Support 8

III.I. Reporting of Fraud, Waste, and Abuse 10

2

III.J.

Whistleblower Protection

11

III.K.

Liability and Safety Issues

12

III.L.

Award Monitoring

12

III.M.

Non-Discrimination Public Notice and Records Compliance

12

III.N.

Identification of Funding

14

III.O.

Award Products

14

III.P.

Suspension or Termination of Award

14

III.Q. Trafficking in Persons 15

III.R. System of Award Management (SAM) and Universal Identifier

Requirements (Required Provision Under 2 CFR § 25.220)

17

III.S.

Transparency Act Requirements (For Grants and Cooperative

Agreements of $30,000 or more)

18

III.T. Conflict of Interest 21

III.U. Award Terms and Conditions for Recipient Integrity and

Performance Matters (Required Provision under 2 CFR §

200.210(b)(iii) for Grants and Cooperative Agreements of

$500,000 or more)

22

III.V. Breaches of Personally Identifiable Information (PII) 24

IV.

Program Civil Rights and Non-Harassment Policy

24

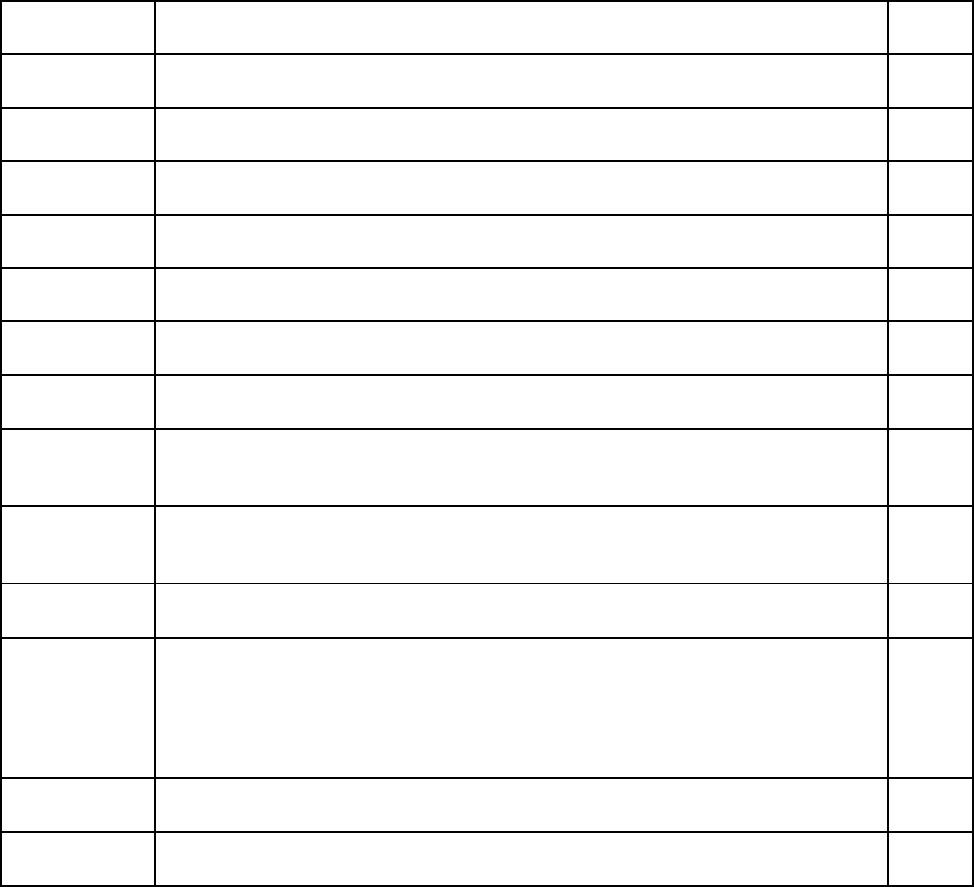

I. CHANGES FROM THE 2022 GENERAL TERMS AND CONDITIONS

A. Section III.F.: Updated to reflect National Service Criminal History Check Requirements

enacted in 2021.

B. Section III.H.: Updated Recognition of AmeriCorps Support to reflect current requirements.

C. Section III.I.: Updated to include the Office of Inspector General’s new web-

based portal to report Fraud, Waste, and Abuse.

3

II. GOVERNING AUTHORITIES

A. LEGISLATIVE AND REGULATORY AUTHORITY

This award is authorized by and subject to The National and Community Service Act

of 1990, as amended, (42 U.S.C. 12501 et seq.) (NCSA) and/or the Domestic

Volunteer Service Act of 1973, as amended, (42 U.S.C. 4950 et seq.) (DVSA), the

Federal Grant and Cooperative Agreement Act (FGCAA), 31 U.S.C. §§6301-6308,

and AmeriCorps’ implementing regulations in 45 CFR Chapter XII and/or XXV.

Recipients must comply with the requirements of the NCSA and/or DVSA and

AmeriCorps’ implementing regulations, as applicable.

B. OTHER APPLICABLE TERMS AND CONDITIONS

This award is subject to the Uniform Administrative Requirements, Cost Principles,

and Audit Requirements for Federal Awards located at 2 CFR Part 200 and the

agency’s implementing regulation at 2 CFR Part 2205 (hereinafter, the Uniform

Guidance). Award recipients must read, understand, and implement these federal

regulations. 2 CFR Part 200, and the August 2020 amendments thereto are

incorporated into these terms and conditions by reference.

The recipient must comply with all other applicable statutes, executive orders,

regulations, and policies governing the award, including, but not limited to, those

included in 2 CFR Chapter I, as well as those cited in these General Terms and

Conditions and Program-Specific Terms and Conditions, and the Assurances and

Certifications. Some of these requirements are discussed in these General Terms and

Conditions to provide emphasis or additional explanations to recipients. Other

provisions are included in these AmeriCorps’ General Terms and Conditions because

they are required by specific laws or regulations.

In addition to the applicable statutes and regulations referred to above, the recipient

must comply with and perform its award consistent with the requirements stated in:

1. The Notice of Grant Award and Signature Page;

2. These General Terms and Conditions;

3. The Program-Specific Terms and Conditions;

4. The Notice of Funding Availability;

5. The recipient’s approved application (including the final approved budget,

attachments, and pre-award negotiations); and

6. Grant Certification and Assurances.

4

C. ORDER OF PRECEDENCE

Any inconsistency in the authorities governing the Award shall be resolved by giving

precedence in the following order: (a) applicable Federal statutes, (b) applicable

Federal regulations, (c) Notice of Grant Award and Signature Page; (d) AmeriCorps

Program Specific Terms and Conditions, (e) AmeriCorps General Terms and

Conditions, (f) the Notice of Funding Opportunity, and (g) the approved Award

Application including all assurances, certifications, attachments, and pre-award

negotiations.

III. GENERAL TERMS AND CONDITIONS

A. RESPONSIBILITIES UNDER AWARD ADMINISTRATION

1. Accountability of the Recipient. The recipient has full fiscal and programmatic

responsibility for managing all aspects of the award and award-supported

activities, subject to the oversight of AmeriCorps. The recipient is accountable to

AmeriCorps for its operation of the program and the use of AmeriCorps award

funds. The recipient must expend award funds in a manner consistent with the

cost principles in 2 CFR and in a reasonable manner, and it must record accurately

the service activities and outcomes achieved under the award. Although

recipients are encouraged to seek the advice and opinion of AmeriCorps on

special problems that may arise, such advice does not diminish the recipient’s

responsibility for making sound judgments and does not shift the responsibility

for operating decisions to AmeriCorps.

2. Subawards. If authorized by law and permitted by AmeriCorps, a recipient may

make subawards in accordance with the requirements set forth in the Uniform

Guidance. The recipient must have and implement a plan for oversight and

monitoring that complies with the requirements applicable to pass through

entities identified at 2 CFR § 200.332 to ensure that each subrecipient has agreed

to comply, and is complying, with award requirements.

A recipient of a Federal award that is a pass-through entity has certain obligations

to its subrecipients. Those requirements are located at 2 CFR §200.208,

§ 200.332, § 200.339, and 2 CFR Part 200 Subpart F.

3. Notice to AmeriCorps. The recipient will notify the appropriate AmeriCorps

Portfolio Manager immediately of any developments or delays that have a

significant impact on funded activities, any significant problems relating to the

administrative or financial aspects of the award, or any suspected misconduct or

malfeasance related to the award or recipient. The recipient will inform the

AmeriCorps Portfolio Manager about the corrective action taken or contemplated

5

by the recipient and any assistance needed to resolve the situation. Recipients

must also ensure that they comply with the mandatory reporting requirements for

suspected criminal activity or fraud, waste or abuse as specified in section III. I.

B. FINANCIAL MANAGEMENT STANDARDS

1. General. The recipient must maintain financial management systems that comply

with 2 CFR § 200.302(b). The recipient’s financial management systems must be

capable of distinguishing expenditures attributable to this award from

expenditures not attributable to this award. The systems must be able to identify

costs by program year and by budget category, and to differentiate between

direct and indirect costs. For all recipient’s financial management requirements

and responsibilities, refer to Subparts D and E of 2 CFR Part 200.

2. Allowability of Costs. To be allowable under an award, costs must meet the

criteria of 2 CFR § 200.403, which provides that costs must be necessary and

reasonable for the performance of the award, must conform to limitations in the

award or 2 CFR Part 200 as to types or amounts of cost items, must be consistent

with policies and procedures that apply uniformly to both Federally financed and

other activities of the recipient, must be adequately documented, and must not

be included as a cost or used to meet cost share or matching requirements of

any other Federally financed program. Furthermore, the costs must be accorded

consistent treatment in like circumstances as either direct or indirect costs in

order to avoid the double charging of Federal awards (see 2 CFR § 200.403(d)

and § 200.412).

3. Cost Reporting. Recipients will be reporting their Federal cash disbursements

quarterly through the Payment Management System (PMS) at the Department of

Health and Human Services and their Federal share of grant program

expenditures (including indirect costs) semi- annually through AmeriCorps’

eGrants system. Recipient’s financial management systems must be able to

routinely produce reports which support and reconcile to the amounts reported

to PMS and eGrants. As part of closing out individual awards, recipients must

submit a quarterly report to PMS and ensure it reconciles to the drawn amount

and FFR in eGrants as applicable within 120 days of the end of the project

period. Recipients must also ensure that the financial management systems of

any subrecipients can routinely produce the same reports. As part of its ongoing

fiscal oversight of recipients, AmeriCorps may randomly select recipients to

provide reports supporting their Federal cash disbursements reported to PMS

(including supporting information for cash disbursements made by

subrecipients). AmeriCorps expects recipients’ and subrecipients’ financial

6

management systems to be able to produce those supporting reports on a

routine basis.

4. Audits. Recipient organizations that expend $750,000 or more in total Federal

awards in a fiscal year shall have a single or program-specific audit conducted for

that year in accordance with the Single Audit Act, as amended, 31 U.S.C. 7501, et

seq., and 2 CFR Part 200, Subpart F. If the recipient expends Federal awards

under only one Federal program, it may elect to have a program specific audit, if

it is otherwise eligible. A recipient that does not expend $750,000 in Federal

awards is exempt from the audit requirements for that year. However, it must

continue to conduct financial management reviews of its subrecipients, and its

records and its subrecipients’ records must be available for review and audit in

accordance with 2 CFR §§ 200.334-200.338 and §200.332(a)(5). Additionally, a

recipient acting as a pass-through entity must issue management decisions for

audit findings pertaining to the Federal award provided to the subrecipient as

required by 2 CFR § 200.521 and ensure follow-up on audit findings in a timely

manner to ensure that the subrecipient corrects any deficiencies identified in the

audit.

C. CHANGES IN BUDGET OR KEY PERSONNEL

All budget and programmatic changes must comply with 2 CFR § 200.308 – Revision

of budget and program plans. 2 CFR § 200.407 Prior written approval (prior

approval) – provides an exhaustive list of those other items requiring AmeriCorps’

advance approval.

D. BANKRUPTCY

The recipient must notify AmeriCorps if, during the term of its award, the recipient or

one of its subrecipients becomes insolvent or is unable to pay its debts as they

mature, or files a voluntary petition in bankruptcy or is the subject of an involuntary

petition that is neither stayed nor dismissed within 60 days after the petition is filed.

E. PROHIBITED PROGRAM ACTIVITIES

The recipient must comply with, and require all subrecipients to comply with, the

prohibitions on use of AmeriCorps funds applicable to their program as identified in

sections 132A and 174 of the NCSA (42 U.S.C. §§ 12584a and 12634) and section

403 of the DVSA (42 U.S.C. § 5043), and provisions by Congress in annual

appropriations acts. More specific guidance on these prohibitions will be provided in

AmeriCorps’ Program Specific Terms and Conditions and in other guidance.

7

F. NATIONAL SERVICE CRIMINAL HISTORY CHECK REQUIREMENTS

The National Service Criminal History Check (NSCHC) is a screening procedure

established by law to protect the beneficiaries of national service. On February 24,

2021, AmeriCorps published a new NSCHC regulation that went into effect May 1,

2021. See45 CFR §§ 2540.200-2540.207 and National Service Criminal History

Checks for complete information and FAQs. The regulation requires recipients to

conduct and document NSCHCs on specific individuals. Refer to

45 CFR §§ 2540.200-2540.201 for the list of entities and individuals required to

comply with NSCHC. The NSCHC must be conducted, reviewed, and an eligibility

determination made by the grant recipient based on the results of the NSCHC no

later than the day before a person begins to work or serve on an NSCHC-required

grant. An individual is ineligible to work or serve in a position specified in 45 CFR §

2540.201(a) if the individual is registered, or required to be registered, as a sex

offender or has been convicted of murder. The cost of conducting NSCHCs is an

allowable expense under the award.

Unless AmeriCorps has provided a recipient with a written waiver, recipients must

perform the following checks for each individual in a position specified in

45 CFR § 2540.201(a):

1. A nationwide name-based search of the National Sex Offender Public Website

(NSOPW); and

2. A name- or fingerprint-based check of the state criminal history record repository

or agency-designated alternative for the person’s state of residence and state

where the person will serve/work; and

3. A fingerprint-based FBI criminal history check through the state criminal history

record repository or agency-approved vendor.

One way for grant recipients or subrecipients to obtain and document the required

components of the NSCHC is through the use of agency-approved vendors.

Recipients and subrecipients must retain adequate documentation that they

completed all required components of the NSCHC specified in 45 CFR §§ 2540.200-

2540.207. Inability to demonstrate that you conducted a required criminal history

check component, to include the NSOPW, as specified in the regulations, may result

in sanctions which may include disallowance of costs.

G. THE OFFICE OF INSPECTOR GENERAL

AmeriCorps’ Office of Inspector General (OIG) conducts and supervises independent

audits, evaluations, and investigations of AmeriCorps’ programs and operations.

Based on the results of these audits, reviews, and investigations, the OIG

8

recommends disallowing costs and also recommends amending or adding policies

to promote economy and efficiency and to prevent and detect fraud, waste, and

abuse in AmeriCorps’ programs and operations.

The OIG conducts and supervises audits of AmeriCorps recipients, as well as legally

required audits and reviews. The legally required audits include evaluating

AmeriCorps’ compliance with the Payment Integrity Information Act of 2019, which

may result in grantees being requested to produce responsive documentation. The

OIG uses a risk-based approach, along with input received from AmeriCorps

management, to select recipients and awards for audit. The OIG hires independent

audit firms to conduct some of its audits. The OIG audit staff is available to discuss

any audit and can be reached at (202) 606-9390.

Recipients must cooperate fully with AmeriCorps requests for documentation and

OIG inquiries by timely disclosing complete and accurate information pertaining to

matters under investigation, audit or review, and by not concealing information or

obstructing audits, inspections, investigations, or other official inquiries.

H. RECOGNITION OF AMERICORPS SUPPORT

1. General Statement. Recipients and subrecipients of federal agency AmeriCorps

assistance or resources shall identify their programs, projects or initiatives as

AmeriCorps or AmeriCorps Seniors programs or projects accordingly. All

agreements with subrecipients, operating sites, or service locations, related to

AmeriCorps programs and initiatives must explicitly state that the program is an

AmeriCorps or AmeriCorps Seniors program.

Similarly, recipients and subrecipients shall identify all national service members

or volunteers serving at their programs, projects or initiatives as either

AmeriCorps members, AmeriCorps Seniors volunteers, Day of Service

volunteers or where appropriate for Volunteer Generation Fund simply

“volunteers.”

2. Visual Representations and Prominent Display. Recipients shall identify their

programs, projects, or initiatives, and their members or volunteers, through the

use of visual representations, including: logos; insignias; written

acknowledgements, publications and other written materials; websites and

social media platforms; and service gear such as clothing. All visual

representations must follow current AmeriCorps branding guidelines, which

include proper logo use and cobranding requirements. To provide recipients

technical assistance in ensuring compliance with proper logo use and

cobranding requirements, AmeriCorps provides brand guidelines, to which

9

recipients and subrecipients should refer and follow. The brand guidelines are

available at Communication resources | AmeriCorps.

All recipient and subrecipient websites and social media communications shall

clearly state, as appropriate, that they are an AmeriCorps recipient or funded by

a grant from AmeriCorps and shall prominently display the AmeriCorps or

AmeriCorps Seniors logo. Logo graphics should be embedded with a link back

to the AmeriCorps.gov home page (referral link) or to an AmeriCorps program-

specific web page at AmeriCorps.gov. Recipients and subrecipients shall

prominently display the AmeriCorps, AmeriCorps Seniors, or appropriate

AmeriCorps Day of Service name and logo on all service gear and public

materials, in accordance with AmeriCorps’ requirements. Public materials are

defined in the branding toolkit.

3. Acknowledgement and Disclaimer on Published Materials. The appropriate

AmeriCorps or AmeriCorps Seniors logo shall be included on publications

related to an award of AmeriCorps assistance or resources. An

acknowledgement and disclaimer shall be displayed on all reports and other

published materials based upon work supported by the award. The

acknowledgement and disclaimer may contain language the same as or similar

to:

This material is based upon work supported by AmeriCorps under Grant No(s) [].

Opinions or points of view expressed in this document are those of the authors

and do not necessarily reflect the official position of, or a position that is

endorsed by, AmeriCorps.”

4. Brand Identification through Publicity. Recipients shall provide information or

training to their AmeriCorps members, AmeriCorps Seniors volunteers, Day of

Service volunteers, or Volunteer Generation Fund volunteers about how their

programs, projects or initiatives are part of AmeriCorps. Recipients are strongly

encouraged to place signs that include the AmeriCorps or AmeriCorps Seniors

name and logo, or the appropriate AmeriCorps version of the Day of Service

logo at all their service sites and may use the slogan “AmeriCorps Serving Here”

or “AmeriCorps Seniors Serving Here,” as appropriate.

When AmeriCorps members and programs or AmeriCorps Seniors volunteers

and programs are publicized – including but not limited to public speaking

opportunities, press releases, news stories, blog posts, websites, social media

posts, online videos, public service announcements, paid advertising, brochures

and other communications channels – individuals must be identified as

AmeriCorps members or AmeriCorps Seniors volunteers, while programs should

10

be identified as AmeriCorps or AmeriCorps Seniors programs or projects and,

where possible, appropriate logos must be displayed.

5. Alteration of Brand Identities Prohibited Without AmeriCorps Written

Permission. Recipients may not alter the AmeriCorps or AmeriCorps Seniors

logos or other AmeriCorps branding and must obtain written permission from

AmeriCorps before using the AmeriCorps name or logo, or the AmeriCorps

Seniors name or logo on materials that will be sold. Recipients must also obtain

written permission from AmeriCorps before permitting donors to use the

AmeriCorps name or logo, or the AmeriCorps Seniors name or logo in

promotional materials.

6. Prohibited Use or Display of Names and Logos for Certain Activities. The

recipient or subrecipient may not use or display the AmeriCorps name or logo,

or the AmeriCorps Seniors name or logo in connection with any activity

prohibited by statute or regulation, including any political activities.

I. REPORTING OF FRAUD, WASTE, AND ABUSE

Recipients must contact the OIG and their Portfolio Manager without delay when

they first suspect:

1. Any criminal activity or violations of law has occurred, such as:

• Fraud, theft, conversion, misappropriation, embezzlement, or misuse of

funds or property by any person, including AmeriCorps personnel,

grantees, or contractors—even if no federal funds or property was

involved;

• Submission of a false claim or a false statement by any person in

connection with any AmeriCorps program, activity, grant or operations;

• Concealment, forgery, falsification, or unauthorized destruction of

government or program records;

• Corruption, bribery, kickbacks, acceptance of illegal gratuities,

extortion, or conflicts of interest in connection with operations,

programs, activities, contracts, or grants;

• Other misconduct in connection with operations, programs, activities,

contracts, or grants; or

• Mismanagement, abuse of authority, or other misconduct by

AmeriCorps personnel.

2. Fraud, waste, or abuse.

• Fraud occurs when someone is intentionally dishonest or uses

intentional misrepresentation or misleading omission to receive

11

something of value or to deprive someone, including the government,

of something of value.

• Waste occurs when taxpayers do not receive reasonable value for their

money in connection with a government-funded activity due to an

inappropriate act or omission by people with control over or access to

government resources.

• Abuse is behavior that is deficient, objectively unreasonable, or

improper under the circumstances. Abuse also includes the misuse of

authority or position for personal financial gain or the gain of an

immediate or close family member or business associate.

The OIG maintains a hotline to receive this information, which can be reached via a

web-based hotline portal or by telephone at (800) 452-8210. Upon request, OIG will

take appropriate measures to protect the identity of any individual who reports

misconduct, as authorized by the Inspector General Act of 1978, as amended.

Reports to OIG may also be made anonymously.

The recipient should take no further steps to investigate suspected misconduct,

except as directed by the OIG or to prevent the destruction of evidence or

information.

J. WHISTLEBLOWER PROTECTION

1. This award and employees working on this award will be subject to the

whistleblower rights and remedies in the pilot program on Contractor employee

whistleblower protections established at 41 U.S.C. 4712 by section 828 of the

National Defense Authorization Act for Fiscal Year 2013 (Pub. L. 112-239).

2. An employee of a recipient may not be discharged, demoted, or otherwise

discriminated against as a reprisal for disclosing information that the employee

reasonably believes is evidence of gross mismanagement of a Federal contract

or award, a gross waste of Federal funds, an abuse of authority (an arbitrary and

capricious exercise of authority that is inconsistent with the mission of

AmeriCorps or the successful performance of a contract or award of

AmeriCorps) relating to a Federal contract or award, a substantial and specific

danger to public health or safety, or a violation of law, rule, or regulation related

to a Federal contract (including the competition for or negotiation of a contract)

or award.

3. The recipient shall inform its employees and contractors in writing, in the

predominant language of the workforce or organization, of employee

whistleblower rights and protections under 41 U.S.C. 4712, as described above

and at Whistleblower Rights and Protections | AmeriCorps (americorpsoig.gov).

12

K. LIABILITY AND SAFETY ISSUES

The recipient must institute safeguards as necessary and appropriate to ensure the

safety of members and volunteers. Members and volunteers may not participate in

projects that pose undue safety risks. Any insurance costs under the award must

comply with 2 CFR § 200.447, which outlines what insurance costs are allowable.

L. AWARD MONITORING

1. Monitoring Activities. AmeriCorps may conduct on-site or remote monitoring

activities to review and evaluate recipient records, accomplishments,

organizational procedures and financial control systems; to make verifications of

recipient compliance with the terms of the award; to conduct interviews; to

identify any practice or procedure that may require further scrutiny; and to

provide technical assistance.

2. Responding to information requests. Pursuant to 2 CFR 200.337, AmeriCorps

may request documentation from recipients in order to monitor the award or to

comply with other legal requirements, such as the Payment Integrity Information

Act of 2019. Failure to make timely responses to such requests may result in

award funds being placed on temporary manual hold, reimbursement only,

or other remedies as appropriate.

M. NON-DISCRIMINATION PUBLIC NOTICE AND RECORDS COMPLIANCE

1. Public Notice of Non-discrimination. The recipient must notify members,

community beneficiaries, applicants, program staff, and the public, including

those with impaired vision or hearing, that it operates its program or activity

subject to the non-discrimination requirements applicable to their program found

at §§ 175 and 176(f) of the NCSA or § 417 of the DVSA, and relevant program

regulations found at 45 CFR Parts 2540 (AmeriCorps State and National), 2551

(Senior Companion Program), 2552 (Foster Grandparent Program), 2553 (RSVP),

and 2556 (AmeriCorps VISTA). The notice must summarize the requirements,

note the availability of compliance information from the recipient and

AmeriCorps, and briefly explain procedures for filing discrimination complaints

with AmeriCorps.

Recipients and subrecipients must also prominently post and make program

participants aware of AmeriCorps’ Program Civil Rights and Non-Harassment

Policy which is reissued annually and available at AmeriCorps.gov.

13

The recipient must include information on civil rights requirements, complaint

procedures and the rights of beneficiaries in member or volunteer service

agreements, handbooks, manuals, pamphlets, and post in prominent locations, as

appropriate. The recipient must also notify the public in recruitment material and

application forms that it operates its program or activity subject to the

nondiscrimination requirements. Sample language, in bold print, is: This

program is available to all, without regard to race, color, national origin,

gender, age, religion, sexual orientation, disability, gender identity or

expression, political affiliation, marital or parental status, genetic

information and military service. Where a significant portion of the population

eligible to be served needs services or information in a language other than

English, the recipient shall take reasonable steps to provide written material of the

type ordinarily available to the public in appropriate languages.

2. Prohibition Against National Origin Discrimination Affecting Limited

English Proficient (LEP) Persons. Pursuant to Executive Order (EO) 13166 –

Improving Access to Services for Persons with Limited English Proficiency,

recipients are required to provide meaningful access to their programs and

activities by LEP persons. For more information, please see the policy guidance

at 67 FR 64604.

3. Records and Compliance Information. The recipient must keep records and

make available to AmeriCorps timely, complete, and accurate compliance

information to allow AmeriCorps to determine if the recipient is complying with

the civil rights statutes and implementing regulations. Where a recipient extends

Federal financial assistance to subrecipients, the subrecipients must make

available compliance information to the recipient so it can carry out its civil rights

obligations in accordance with the records requirements at

2 CFR §§ 200.334200.338 and § 200.331(a)(5).

4. Obligation to Cooperate. The recipient must cooperate with AmeriCorps so

that AmeriCorps can ensure compliance with the civil rights statutes and

implementing regulations. The recipient shall permit access by AmeriCorps

during normal business hours to its books, records, accounts, staff, members or

volunteers, facilities, and other sources of information as may be needed to

determine compliance. The recipient and subrecipients must cooperate when

contacted regarding investigations into allegations of discrimination including,

but not limited, to providing requested documentation and making relevant

officials available to provide information and/or statements.

14

N. IDENTIFICATION OF FUNDING

When issuing statements, press releases, requests for proposals, bid solicitations and

other documents describing projects or programs funded in whole or in part with

Federal money, all grantees receiving AmeriCorps funds included, shall clearly state—

(1) the percentage of the total costs of the program or project which will be financed

with Federal money; (2) the dollar amount of Federal funds for the project or

program; and (3) the percentage and dollar amount of the total costs of the project

or program that will be financed by non-governmental sources.

O. AWARD PRODUCTS

1. Sharing Award Products. To the extent practicable, the recipient agrees to

make products produced under the award available at the cost of reproduction

to others in the field.

2. Acknowledgment of Support. Publications created by members, volunteers or

award-funded staff must be consistent with the purposes of the award. The

appropriate AmeriCorps logo shall be included on such documents. The

recipient is responsible for assuring that the following acknowledgment and

disclaimer appears in any external report or publication of material based upon

work supported by this award:

“This material is based upon work supported by AmeriCorps, the operating name

of the Corporation for National and Community Service, under Grant No(s).[].

Opinions or points of view expressed in this document are those of the authors

and do not necessarily reflect the official position of, or a position that is endorsed

by, AmeriCorps or [the relevant AmeriCorps program].”

P. SUSPENSION OR TERMINATION OF AWARD

AmeriCorps may suspend or terminate this award in accordance with 2 CFR §§ 200.

200.339 and 200.340 (85 FR 49506, 49559-60) such as applicable AmeriCorps

regulations and statutes. In addition, a recipient may suspend or terminate assistance

to one of its subrecipients in accordance with 2 CFR §§ 200.339 and 200.340,

provided that such action complies with 2 CFR § 200.341. 2 CFR § 200.340(a)(2)

prohibits arbitrary termination of grant awards by AmeriCorps. As before the

clarifications to 2 CFR Part 200, AmeriCorps may initiate termination for cause, or

when (based on new evidence) there is a significant question about the feasibility or

effectiveness of the intended objective of the award.

15

Q. TRAFFICKING IN PERSONS

This award is subject to requirements of Section 106(g) of the Trafficking Victims

Protection Act of 2000, as amended (22 U.S.C. § 7104).

1. Provisions applicable to a recipient that is a private entity.

a. You as the recipient, your employees, subrecipients under this award, and

subrecipients' employees may not:

i. Engage in severe forms of trafficking in persons during the period

of time that the award is in effect;

ii. Procure a commercial sex act during the period of time that the

award is in effect; or

iii. Use forced labor in the performance of the award or subawards

under the award.

b. We as the Federal awarding agency may unilaterally terminate this award,

without

penalty, if you or a subrecipient that is a private entity

i. Violates a prohibition in paragraph (a.) of this award term; or

ii. Has an employee who violates a prohibition in paragraph (a.) of

this award term through conduct that is either:

(A.) Associated with performance under this award; or

(B.) Imputed to you or the subrecipient using the standards and

due process for imputing the conduct of an individual to an

organization that are provided in 2 CFR Part 180, “OMB

guidelines to Agencies on Government-wide Debarment and

Suspension (Non-procurement),” as implemented by our

agency at 2 CFR Part 2200.

2. Provisions applicable to a recipient other than a private entity. We as the

Federal awarding agency may unilaterally terminate this award, without

penalty, if a subrecipient that is not a private entity–

a. Is determined to have violated an applicable prohibition of paragraph

(1)(a.) of this award term; or

b. Has an employee who is determined by the agency official authorized to

terminate the award to have violated an applicable prohibition in

paragraph (1)(a)(i) of this award term through conduct that is –

i. Associated with performance under this award; or

ii. Imputed to you using the standards and due process for imputing

conduct of an individual to an organization that are provided in

2 CFR Part 180, “OMB Guidelines to Agencies on Government-

wide Debarment and Suspension (Non-procurement),” as

implemented by our agency at 2 CFR Part 2200.

16

3. Provisions applicable to any recipient.

a. You must inform us immediately of any information you receive from any

source alleging a violation of a prohibition in paragraph (1)(a) of this award

term.

b. Our right to terminate unilaterally that is described in paragraph (1) and (2)

of this section:

i. Implements section 106(g) of the Trafficking Victims Protection Act

of 2000 (TVPA), as amended (22 U.S.C. 7104(g)), and

ii. Is in addition to all other remedies for noncompliance that are

available to us under this award.

c. You must include the requirements of paragraph (1)(a) of this award term

in any subaward you make to a private entity.

4. Definitions. For purposes of this award term:

a. “Employee” means either:

i. An individual employed by you or a subrecipient who is engaged

in the performance of the project or program under this award; or

ii. Another person engaged in the performance of the project or

program under this award and not compensated by you including,

but not limited to, a volunteer or individual whose service are

contributed by a third party as an in-kind contribution toward cost

sharing or matching requirements.

b. “Forced labor” means labor obtained by any of the following methods: the

recruitment, harboring, transportation, provision, or obtaining of a person

for labor or services, through the use of force, fraud, or coercion for the

purpose of subjection to involuntary servitude, peonage, debt bondage,

or slavery.

c. “Private entity”:

i. Means any entity other than a State, local government, Indian tribe,

or foreign public entity, as those terms are defined in

2 CFR §175.25.

ii. Includes:

(a.) A nonprofit organization, including any non-profit institution

of higher education, hospital, or tribal organization other

than one included in the definition of Indian tribe at

2 CFR § 175.25(b).

(b.) A for-profit organization.

d. “Severe forms of trafficking in persons,” “commercial sex act,” and

“coercion” have the meanings given at section 103 of the TVPA, as

amended (22 U.S.C. § 7102).

17

R. SYSTEM FOR AWARD MANAGEMENT (SAM) and UNIVERSAL IDENTIFIER

REQUIREMENTS (Required provision under 2 CFR § 25.220)

1. Requirement for System for Award Management (SAM) Registration: Unless you

are exempted from this requirement under 2 CFR § 25.110, you as the recipient

must maintain the currency of your SAM registration information until you submit

the final financial report required under this award or receive the final payment,

whichever is later. This requires that you review and update the information at

least annually after the initial registration, and more frequently if required by

changes in your information or another award term. Additionally, recipients’

legal applicant name and physical address in eGrants must align exactly to the

information in their SAM registration.

2. Requirement for Unique Entity Identifier: If you are authorized to make

subawards under this award, you:

a. Must have a Unique Entity Identifier

b. Must notify potential subrecipients that no entity (see definition in

paragraph c of this award term) may receive a subaward from you unless

the entity has provided its unique entity identifier to you.

c. May not make a subaward to an entity unless the entity has provided its

unique entity identifier to you.

3. Definitions. For purposes of this award term:

System for Award Management (SAM) means the Federal repository for standard

information about applicants and recipients. Additional information about registration

procedures may be found at the SAM Internet site (currently at

https://www.sam.gov/content/Home).

a. Unique Entity Identifier (UEI) is the universal identifier for Federal financial

assistance applicants, as well as recipients and their direct subrecipients. It

is generated by SAM.

b. Subaward:

i. This term means a legal instrument to provide support for the

performance of any portion of the substantive project or program for

which you received this award and that you as the recipient award to

an eligible subrecipient.

ii. The term does not include your procurement of property and

services needed to carry out the project or program (for further

explanation, see 2 CFR § 200.330.

iii. A subaward may be provided through any legal agreement,

including an agreement that you consider a contract.

18

b. Subrecipient means an entity that:

i. Receives a subaward from you under this award; and

ii. Is accountable to you for the use of the Federal funds provided by

the subaward.

S. TRANSPARENCY ACT REQUIREMENTS (for Grants and Cooperative

Agreements of $30,000 or More)

Reporting Subawards and Executive Compensation:

1. Reporting of first-tier subawards.

a. Applicability. Unless you are exempt as provided in paragraph 4, of this

award term (below), you must report each action that obligates $30,000 or

more in Federal funds that does not include Recovery funds (as defined in

section 1512(a)(2) of the American Recovery and Reinvestment Act of 2009,

Pub. L. 111-5) for a subaward to an entity (see definitions in paragraph 5. of

this award term).

b. Where and when to report.

i. You must report each obligating action described in paragraph 1.a.

of this award term to http://www.fsrs.gov.

ii. For subaward information, report no later than the end of the month

following the month in which the obligation was made. (For

example, if the obligation was made on November 7

th

in a given

year, the obligation must be reported by no later than the end of

December.)

c. What to report.

i. You must report the information about each obligating action that

the submission instructions posted at http://www.fsrs.gov specify.

2. Reporting Total Compensation of Recipient Executives.

a. Applicability and what to report. You must report total compensation for each

of your five most highly compensated executives for the preceding

completed fiscal year, if--

i. The total Federal funding authorized to date under this award is

$30,000 or more;

ii. In the preceding fiscal year, you received--

(a.) 80 percent or more of your annual gross revenues from

Federal procurement contracts (and subcontracts) and

Federal financial assistance subject to the Transparency Act,

as defined at 2 CFR § 170.320 (and subawards); and

(b.) $25,000,000 or more in annual gross revenues from Federal

procurement contracts (and subcontracts) and Federal

19

financial assistance subject to the Transparency Act, as

defined at 2 CFR § 170.320 (and subawards); and

iii. The public does not have access to information about the

compensation of the executives through periodic reports filed

under section 13(a) or 15(d) of the Securities Exchange Act of 1934

(15 U.S.C. §§ 78m(a), 78o(d)) or section 6104 of the Internal

Revenue Code of 1986. (To determine if the public has access to

the compensation information, see the U.S. Security and Exchange

Commission total compensation filings at

http://www.sec.gov/answers/execomp.htm.)

b. Where and when to report. You must report executive total compensation

described in paragraph (2.)(a.) of this award term:

i. As part of your registration profile

https://www.sam.gov/content/Home by the end of the month

following the month in which this award is made, and annually

thereafter.

3. Reporting of Total Compensation of Subrecipient Executives.

a. Applicability and what to report. Unless you are exempt as provided in paragraph 4.

of this award term, for each first-tier subrecipient under this award, you

shall report the names and total compensation of each of the

subrecipient's five most highly compensated executives for the

subrecipient's preceding completed fiscal year, if--

i. In the subrecipient's preceding fiscal year, the subrecipient received--

(a.) 80 percent or more of its annual gross revenues from Federal

procurement contracts (and subcontracts) and Federal financial

assistance subject to the Transparency Act, as defined at 2 CFR

§170.320 (and subawards); and

(b.) $25,000,000 or more in annual gross revenues from Federal

procurement contracts (and subcontracts), and Federal

financial assistance subject to the Transparency Act, as defined

at 2 CFR §170.320 (and subawards); and

ii. The public does not have access to information about the

compensation of the executives through periodic reports filed

under section 13(a) or 15(d) of the Securities Exchange Act of 1934

(15 U.S.C. §§ 78m(a), 78o(d)) or section 6104 of the Internal

Revenue Code of 1986. (To determine if the public has access to

the compensation information, see the U.S. Security and Exchange

Commission total compensation filings at

http://www.sec.gov/answers/execomp.htm.)

b. Where and when to report. You must report subrecipient

executive total compensation described in paragraph 3.a. of

this award term:

20

i. To the recipient.

ii. By the end of the month following the month during which you

make the subaward. For example, if a subaward is obligated on any

date during the month of October of a given year (i.e., between

October 1 and 31), you must report any required compensation

information of the subrecipient by November 30 of that year.

4. Exemptions. If, in the previous tax year, you had gross income, from all sources,

under $300,000, you are exempt from the requirements to report:

a. Subawards, and

b. The total compensation of the five most highly compensated executives of

any subrecipient.

5. Definitions. For purposes of this award term:

a. Entity means all of the following, as defined in 2 CFR Part 25:

i. A Governmental organization, which is a State, local government,

or Indian tribe;

ii. A foreign public entity;

iii. A domestic or foreign nonprofit organization;

iv. A domestic or foreign for-profit organization;

v. A Federal agency, but only as a subrecipient under an award or

subaward to a non- Federal entity.

b. Executive means officers, managing partners, or any other employees in

management positions.

c. Subaward:

i. This term means a legal instrument to provide support for the

performance of any portion of the substantive project or program

for which you received this award and that you as the recipient

award to an eligible subrecipient.

ii. The term does not include your procurement of property and

services needed to carry out the project or program (for further

explanation, see 2 CFR § 200.331).

iii. A subaward may be provided through any legal agreement,

including an agreement that you or a subrecipient considers a

contract.

d. Subrecipient means an entity that:

i. Receives a subaward from you (the recipient) under this award;

and

ii. Is accountable to you for the use of the Federal funds provided by

the subaward.

21

e. Total compensation means the cash and noncash dollar value earned by

the executive during the recipient's or subrecipient's preceding fiscal year and

includes the following (for more information see 17 CFR §229.402(c)(2)):

i. Salary and bonus.

ii. Awards of stock, stock options, and stock appreciation rights. Use

the dollar amount recognized for financial statement reporting

purposes with respect to the fiscal year in accordance with the

Statement of Financial Accounting Standards No. 123 (Revised

2004) (FAS 123R), Shared Based Payments.

iii. Earnings for services under non-equity incentive plans. This does

not include group life, health, hospitalization or medical

reimbursement plans that do not discriminate in favor of

executives, and are available generally to all salaried employees.

iv. Change in pension value. This is the change in present value of

defined benefit and actuarial pension plans.

v. Above-market earnings on deferred compensation which is not

tax-qualified.

vi. Other compensation, if the aggregate value of all such other

compensation (e.g. severance, termination payments, value of life

insurance paid on behalf of the employee, perquisites or

property) for the executive exceeds $10,000.

T. CONFLICT OF INTEREST

You must disclose in writing any potential conflict of interest to your AmeriCorps

Portfolio Manager, or to the pass-through entity if you are a subrecipient or

contractor. This disclosure must take place immediately. The AmeriCorps conflict of

interest policies apply to subawards as well as contracts, and are as follows:

1. As a non-Federal entity, you must maintain written standards of conduct covering

conflicts of interest and governing the performance of your employees engaged

in the selection, award, and administration of subawards and contracts.

2. None of your employees may participate in the selection, award, or

administration of a subaward or contract supported by a Federal award if he or

she has a real or apparent conflict of interest. Such a conflict of interest would

arise when the employee, officer, or agent, any member of his or her immediate

family, his or her partner, or an organization which employs or is about to employ

any of the parties indicated herein, has a financial or other interest in or a

tangible personal benefit from an organization considered for a subaward or

contract. The officers, employees, and agents of the non-Federal entity must

22

neither solicit nor accept gratuities, favors, or anything of monetary value from

subrecipients or contractors or parties to subawards or contracts.

3. If you have a parent, affiliate, or subsidiary organization that is not a State, local

government, or Indian tribe, you must also maintain written standards of conduct

covering organizational conflicts of interest. Organizational conflicts of interest

mean that because of relationships with a parent company, affiliate, or subsidiary

organization, you are unable or appear to be unable to be impartial in

conducting a subaward or procurement action involving a related organization.

U. AWARD TERM AND CONDITION FOR RECIPIENT INTEGRITY AND

PERFORMANCE MATTERS (Required provision under 2 CFR §

200.210(b)(iii) for grants and cooperative agreements of $500,000 or

more)

1. General Reporting Requirement

If the total value of your currently active grants, cooperative agreements, and

procurement contracts from all Federal awarding agencies exceeds $10,000,000 for

any period of time during the period of performance of this Federal award, then you

as the recipient during that period of time must maintain the currency of information

reported to the System for Award Management (SAM) that is made available in the

designated integrity and performance system (currently the Federal Awardee

Performance and Integrity Information System (FAPIIS)) about civil, criminal, or

administrative proceedings described in paragraph 2 of this award term and

condition. This is a statutory requirement under section 872 of Public Law 110-417,

as amended (41 U.S.C. 2313). As required by section 3010 of Public Law 111-212, all

information posted in the designated integrity and performance system on or after

April 15, 2011, except past performance reviews required for Federal procurement

contracts, will be publicly available.

2. Proceedings About Which You Must Report.

Submit the information required about each proceeding that:

a. Is in connection with the award or performance of a grant, cooperative

agreement, or procurement contract from the Federal Government;

b. Reached its final disposition during the most recent five-year period; and

c. Is one of the following:

(1) A criminal proceeding that resulted in a conviction, as defined in

paragraph 5 of this award term and condition;

(2) A civil proceeding that resulted in a finding of fault and liability and

payment of a monetary fine, penalty, reimbursement, restitution, or

damages of $5,000 or more;

23

(3) An administrative proceeding, as defined in paragraph 5 of this award

term and condition, that resulted in a finding of fault and liability and

your payment of either a monetary fine or penalty of $5,000 or more or

reimbursement, restitution, or damages in excess of $100,000; or

(4) Any other criminal, civil, or administrative proceeding if:

(i) It could have led to an outcome described in paragraph 2.c.(1), (2),

or (3) of this award term and condition;

(ii) It had a different disposition arrived at by consent or compromise

with an acknowledgment of fault on your part; and

(iii) The requirement in this award term and condition to disclose

information about the proceeding does not conflict with

applicable laws and regulations.

3. Reporting Procedures

Enter in the SAM Entity Management area the information that SAM requires about

each proceeding described in paragraph 2 of this award term and condition. You do

not need to submit the information a second time under assistance awards that you

received if you already provided the information through SAM because you were

required to do so under Federal procurement contracts that you were awarded.

4. Reporting Frequency

During any period of time when you are subject to the requirement in paragraph 1 of

this award term and condition, you must report proceedings information through

SAM for the most recent five-year period, either to report new information about any

proceeding(s) that you have not reported previously or affirm that there is no new

information to report. Recipients that have Federal contract, grant, and cooperative

agreement awards with a cumulative total value greater than $10,000,000 must

disclose semiannually any information about the criminal, civil, and administrative

proceedings.

5. Definitions

For purposes of this award term and condition:

a. Administrative proceeding means a non-judicial process that is adjudicatory

in nature in order to make a determination of fault or liability (e.g., Securities

and Exchange Commission Administrative proceedings, Civilian Board of

Contract Appeals proceedings, and Armed Services Board of Contract

Appeals proceedings). This includes proceedings at the Federal and State

level but only in connection with performance of a Federal contract or grant.

24

It does not include audits, site visits, corrective plans, or inspection of

deliverables.

b. Conviction, for purposes of this award term and condition, means a

judgment or conviction of a criminal offense by any court of competent

jurisdiction, whether entered upon a verdict or a plea, and includes a

conviction entered upon a plea of nolo contendere.

c. Total value of currently active grants, cooperative agreements, and

procurement contracts includes—

(1) Only the Federal share of the funding under any Federal award with a

recipient cost share or match; and

(2) The value of all expected funding increments under a Federal award and

options, even if not yet exercised.

V. BREACHES OF PERSONALLY IDENTIFIABLE INFORMATION (PII)

All recipients and subrecipients need to be prepared for potential breaches of

Personally Identifiable Information (PII). OMB defines PII as any information about an

individual, including, but not limited to, education, financial transactions, medical

history, and criminal or employment history and information which can be used to

distinguish or trace an individual's identity, such as their name, social security

number, date and place of birth, mother’s maiden name, biometric records, etc.,

including any other personal information which is linked or linkable to an individual.

All recipients and subrecipients must ensure that they have procedures in place to

prepare for and respond to breaches of PII, and notify the Federal awarding agency

in the event of a breach.

If your AmeriCorps grant-funded program or project creates, collects, uses,

processes, stores, maintains, disseminates, discloses, or disposes of PII within the

scope of that Federal grant award, or uses or operates a Federal information system,

you must establish procedures to prepare for and respond to a potential breach of

PII, including notice of a breach of PII to AmeriCorps. Grantees experiencing a

breach should immediately notify AmeriCorps’ Office of Information Technology,

and the AmeriCorps Portfolio Manager.

IV. Program Civil Rights and Non-Harassment Policy.